Friday, December 31, 2010

Bugatti Veyron goes swimming Near Galveston

Estragon and I were speaking of this over lunch at Max and Julies a couple of Friday's ago. The incident below happened a little more than one year ago. Thought I would google it and lo and behold there is actually video of the action live.

Bugatti Veyron $1,700,000. This is by far the most expensive street legal car available on the market today. It is the fastest accelerating car reaching 0-60 in 2.6 seconds. It claims to be the fastest car with a top speed of 253 mph+. However, the title for the fastest car goes to the SSC Ultimate Aero which exceed 253 mph pushing this car to 2nd place for the fastest car.

...and a little trivia, Bugatti's are assembled in the Alsace region of France.

Bugatti Veyron $1,700,000. This is by far the most expensive street legal car available on the market today. It is the fastest accelerating car reaching 0-60 in 2.6 seconds. It claims to be the fastest car with a top speed of 253 mph+. However, the title for the fastest car goes to the SSC Ultimate Aero which exceed 253 mph pushing this car to 2nd place for the fastest car.

Rare species meet; only one survives

Car owner takes sports car's plunge into lake in stride

By PEGGY O'HARE

HOUSTON CHRONICLE

Nov. 12, 2009, 11:09PM

It was a great day for the brown pelican Wednesday, being taken off the endangered species list, but the driver of a rare 2006 Bugatti Veyron EB — one of only 15 in the U.S. — may be wishing he had never set eyes on one of the ungainly creatures.

That's because a low-flying pelican startled him as he was driving on the Interstate 45 feeder in La Marque, causing him to veer off the road and land the million-dollar car in 3 feet of water that reached up to the door handles.

The Lufkin man, whose name La Marque police refused to release, is a collector of exotic cars and had purchased the Bugatti just last month from a Jonesboro, Ark., dealer, who offered it for sale for $1.25 million.

Now, the wayward driver has become something of a celebrity, with his phone ringing off the hook. He told the Texas City wrecker driver who towed his car that California Gov. Arnold Schwarzenegger called him Wednesday, along with several other celebrities.

“He said he was getting so many calls that he finally stopped answering his phone,” said wrecker driver Gilbert Harrison of MCH Truck and Auto, which is storing the mudcaked sports car.

The Bugatti Veyron, made by a Volkswagen subsidiary, is the fastest and most expensive production car in the world, capable of reaching 253 mph, said Elite Autos owner Shelby Smith, who sold the car. The vehicle has 1,001 horsepower and is almost entirely electronic.

Smith, who said his Arkansas dealership does most of its business over the Internet, said he could not disclose the man's name or the final sales price. But Smith said the man is a “repeat customer.”

The Bugatti had only 500 miles on its odometer when the Lufkin man purchased it.

Smith said he spoke to the driver about two hours after the accident and believes the vehicle will be a total loss.

The driver seemed to take his very expensive mistake in stride, Harrison said.

“He was calm,” Harrison said. “If it had been me, I'd have been cussing, but he was calm. I imagine inside he was probably pretty upset.”

The car crashed at 3 p.m. Wednesday as the driver was northbound in the 700 block of the freeway's feeder road and his cell phone slipped out of the car's center console, Smith said. The man was not on his phone at the time, but reached to retrieve it from the floorboard.

When the driver sat up, he was startled by the bird, flying low alongside the Bugatti, Smith said. His right front tire strayed onto the shoulder of the road, said La Marque police Lt. Greg Gilchrist.

“He couldn't regain control,” Gilchrist said, noting that no guardrails separate the road from the water at that point in the road.

The car landed 20 to 25 feet from the feeder road, according to Gilchrist, who said he found no indication that driver had been speeding.

Crabs were seen crawling around the tow truck after the sports car had been loaded on board, said MCH Truck and Auto owner Jim Morris.

“It hurts your ego more than anything,” Smith said of his customer's reaction to the wreck. “He wasn't doing anything stupid.”

...and a little trivia, Bugatti's are assembled in the Alsace region of France.

Labels:

humor

Thursday, December 30, 2010

The Economy is so bad. . .

Jury Duty is now considered a good-paying job.

I got a pre-declined credit card in the mail.

African television stations are now showing ‘Sponsor an American Child’ commercials!

Wives are having sex with their husbands because they can’t afford batteries.

I ordered a burger at McDonald’s and the kid behind the counter asked, “Can you afford fries with that?”

CEO’s are now playing miniature golf.

Goldman Sachs laid off 25 Congressmen.

My ATM gave me an IOU!

A stripper was killed when her audience showered her with rolls of pennies while she danced.

I saw a Mormon polygamist with only one wife.

I bought a toaster oven and my free gift with the purchase was a bank.

If the bank returns your check marked “Insufficient Funds,” you have to call them and ask if they meant you or them.

McDonald’s is now selling the 1/4 ouncer.

Angelina Jolie adopted a child from America .

Parents in Beverly Hills fired their nannies and learned the names of their children.

My cousin had an exorcism but couldn’t afford to pay for it, and they re-possessed her!

A truckload of Americans was caught sneaking into Mexico .

Motel Six won’t leave the light on for you anymore.

A picture is now only worth 200 words.

They renamed Wall Street ” Wal-Mart Street .”

When Bill and Hillary travel together, they now have to share a room.

One of the casinos in Las Vegas is now managed by Somali pirates.

And, finally…I was so depressed last night thinking about the economy, wars, jobs, my savings, Social Security, retirement funds, etc., I called the Suicide Hotline. I got a call center in Pakistan , and when I told them I was suicidal. They got all excited, and asked if I could drive a truck.

I got a pre-declined credit card in the mail.

African television stations are now showing ‘Sponsor an American Child’ commercials!

Wives are having sex with their husbands because they can’t afford batteries.

I ordered a burger at McDonald’s and the kid behind the counter asked, “Can you afford fries with that?”

CEO’s are now playing miniature golf.

Goldman Sachs laid off 25 Congressmen.

My ATM gave me an IOU!

A stripper was killed when her audience showered her with rolls of pennies while she danced.

I saw a Mormon polygamist with only one wife.

I bought a toaster oven and my free gift with the purchase was a bank.

If the bank returns your check marked “Insufficient Funds,” you have to call them and ask if they meant you or them.

McDonald’s is now selling the 1/4 ouncer.

Angelina Jolie adopted a child from America .

Parents in Beverly Hills fired their nannies and learned the names of their children.

My cousin had an exorcism but couldn’t afford to pay for it, and they re-possessed her!

A truckload of Americans was caught sneaking into Mexico .

Motel Six won’t leave the light on for you anymore.

A picture is now only worth 200 words.

They renamed Wall Street ” Wal-Mart Street .”

When Bill and Hillary travel together, they now have to share a room.

One of the casinos in Las Vegas is now managed by Somali pirates.

And, finally…I was so depressed last night thinking about the economy, wars, jobs, my savings, Social Security, retirement funds, etc., I called the Suicide Hotline. I got a call center in Pakistan , and when I told them I was suicidal. They got all excited, and asked if I could drive a truck.

Labels:

humor

Faros Trading Thoughts for 2011 via KWN

"The most important news for currency and commodity markets in 2010 was, in our view, the June move by China to open its currency to a flexible regime. Over the course of the year, we have discussed the ripple effect this has had on currency markets, especially concerning its implication on the USD/Index. We believe that “flexibility” in China means it is actively reallocating reserves. By allowing its currency to strengthen and reallocating reserves, China must buy fewer U.S. dollars in the market, while selling currently owned U.S. dollars and purchasing non-U.S. dollar assets.

For the past six months, we have watched China and other Asian Central Banks buy considerable amounts of EUR, GBP and JPY against the USD as they diversify out of their overweight USD position in their current reserves. They have also continually sold dollars in the London and New York sessions; dollars that they had purchased nightly against their own currencies in order to keep them from strengthening against the dollar, and their exports from becoming uncompetitive relative to their peers. Throughout 2010 China has voiced support for the Euro-zone while quietly chastising the U.S. fiscal situation. We believe Chinese support and ECB resolve will put a floor on EUR/USD weakness. We express this view through a long position in the IMF Special Drawing Rights (SDR) currencies of EUR, GBP and JPY, and through synthetic SDRs.

Last weekend China raised rates. This further supports our view of a stronger CNY and a weaker USD. While many in the market believe that the raising of rates by China is negative for risk, we disagree entirely. From 2005 through 2008, China consistently raised rates while strengthening their currency, which in turn weakened the USD/Index by a similar amount. We remain convinced that China will allow the CNY to strengthen by at least 8 percent against the USD over the course of 2011. Strengthening the CNY is in their interest as it will help combat inflation. It will happen gradually as they increase domestic demand, the overriding theme in their new 5-year plan to be announced in March 2011. We described in greater detail the “Grand Bargain” between China and the U.S. going into the G20 meetings, wherein a gradually stronger CNY against the USD was agreed to be in both country's interest. For this reason we like short USD/CNY. On a similar vein we like short USD positions against KRW, INR and the SGD as the other Asian Central Banks allow their currencies to strengthen against the USD at a similar pace to the CNY.

In the U.S., we believe an unraveling of U.S. Municipal finances given the expiration of the Build America Bonds program will cause growing concern over the USD as the US FED runs out of options and the Tea Party blocks further aid to ailing U.S. states. President Obama has stated many times since September 2010 that his administrations number one goal is to double U.S. exports over the next five years, a statement backed by the National Export Initiative (NEI) which created a government-wide export-promotion strategy that sounds to us like Japan's old Ministry of International Trade and Industry (MITI). A weaker USD is the natural path to achieve this goal. We like shorting the USD/Index in support of this view.

Throughout 2010 we have pointed to the growing commodity purchases by Asian Central Banks over the past year, as we note China bought 209.7 tons of gold from January to October of 2010. China still only holds about 2 percent of its foreign reserves in gold. India holds about 8 percent. By contrast, the Euro area holds about 61 percent of their reserves in gold and the US has about 74 percent. Asian economies are very underweight gold in their reserves portfolio relative to the West. Given the size of their reserves, any form of catch-up will be very bullish for gold.

While we like selling the USD, we have to acknowledge the market's issues and concerns over the European Peripheral, and so we believe that EUR/USD purchases should be paired with purchases in gold. The last time China moved to “flexibility” from mid-2005 to mid-2008 the trade long EUR/USD and long gold (both assets being acquired by Asian Central Banks) rose approximately 174 percent, 40 percent annualized. So far, from June 2010 the trade has moved 20.6 percent (EUR/USD up 6.8 percent and gold up 13.8 percent). The trade is not without volatility; however, we believe that reserve diversification will continue through the year; and given China and other Asian Central Banks are underweight gold and overweight the USD; we are convinced the re-balancing will continue through 2011.

We see 2011 as a continuation of 2010 in terms of the Asian Central Bank re-allocation theme. However, while the pace of USD weakness in 2010 was fueled by QE2 rhetoric, we believe the pace in 2011 will be fueled by concerns over U.S. Municipalities and U.S. States, concerns that will grow to outweigh the issues in Europe that currently hold the market's attention."http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2010/12/28_2011__China_and_Other_Asian_Central_Banks_Light_The_Way.html

Labels:

Currency Wars

Wednesday, December 29, 2010

The Egg House

Dai Haifei (戴海飞), 24 years old form Hunan province, built and placed an egg shaped small house in a courtyard in Beijing, as his home. Inspired by his company’s design, Dai Haifei built the “egg” house with bamboo and it only cost him 6,427 yuan. Now he has been living in it for almost 2 month, rent free.

In 2009 when I was interning for Standard Architecture, I was honored to participate in “egg of the city” (城市下的蛋) design project. “Egg of the city” series includes KTV house (already completed), Bench house (already completed), small shop house, fruit stand house, recycler house, message pallor house, backpackers house… “Egg of the city” series provides movable small homes for struggling group of people in the city, the home is also a tool for them to make a living. The green plants on the surface of the house become urban landscape. After my internship at Standard Architecture, I went back to school to finish up my graduation design, but the idea of building a house for myself was lingering in my mind. After graduation, I talked to my teacher Tang Doudou about my ideas, he was very supportive and found a few friends to help out with my work. Later I also got the finical support from my cousin, then the building work was officially started.

We worked from July to September for two whole months, not counting labor, material costs are as follows:

Wheels 160

Rope ties 125

Grinder 31

Water tank, pump 95

Steel 573

Drills 18

Bamboo 375

Tools 210

Glue 200

Waterproof fabrics 508

Solar Panels 970

Square rods 30

Screws 115

Paint 284

Welders 260

Spray gun 450

Gauze 600

Insulation 100

Grass seeds 110

Energy-saving lamps 36

Air support 50

Plexiglass 160

Washbasin 60

Steel mesh 240

Rope ties 125

Grinder 31

Water tank, pump 95

Steel 573

Drills 18

Bamboo 375

Tools 210

Glue 200

Waterproof fabrics 508

Solar Panels 970

Square rods 30

Screws 115

Paint 284

Welders 260

Spray gun 450

Gauze 600

Insulation 100

Grass seeds 110

Energy-saving lamps 36

Air support 50

Plexiglass 160

Washbasin 60

Steel mesh 240

Total 6427

After the house was built, shipping it from Hunan to Beijing cost 3500 yuan, so with less than ten thousand I got my own house in Beijing.

When the house arrived in Beijing I put it under the building of my company. I already lived in it for over a month. I can get to work within seconds, no need to be on the crowded bus. This is considered a luxury in the traffic congested Beijing.

I used the money I saved up from not paying rent to pay for an annual pass of a swimming gym, so I can go swimming, also take showers and go to sauna there. I don’t have a kitchen in the house, so I became a frequent visitor of the local restaurants around work. No need to make meals also saved me a lot of time. In the weekends, I can go the local coffee shops with a book or I can ride my bike around the neighborhood alleys. When the house is simplified to just one bed, other than sleeping in it, other things are taken care of in public places, this is a free lifestyle.

I used the money I saved up from not paying rent to pay for an annual pass of a swimming gym, so I can go swimming, also take showers and go to sauna there. I don’t have a kitchen in the house, so I became a frequent visitor of the local restaurants around work. No need to make meals also saved me a lot of time. In the weekends, I can go the local coffee shops with a book or I can ride my bike around the neighborhood alleys. When the house is simplified to just one bed, other than sleeping in it, other things are taken care of in public places, this is a free lifestyle.

http://www.flickr.com/photos/30909993@N08/sets/72157625497106626/

http://www.chinahush.com/2010/12/01/young-man-builds-egg-shaped-dwelling-in-beijing-as-his-home/

http://www.mnn.com/your-home/green-building-remodeling/blogs/beijings-incredible-inedible-egg-house

http://nd.oeeee.com/cama/2010/show/201011/t20101102_1155946.shtml

Labels:

art and architecture

Tuesday, December 28, 2010

The Hussman Report (12/20/10) - What John Believes

1) Investors dangerously underestimate the risk of an abrupt and possibly severe equity market plunge

Look back over history at points in time where stocks were trading at a rich multiple to normalized earnings (the Shiller multiple is a useful gauge here, as forward operating and price/peak earnings are both corrupted by profit margins that are about 50% above their historic norms). Combine that with overbought, overbullish conditions and rising interest rates. What you will get is a list of most historical pre-crash peaks. Depending on precisely how you define your classifier, you may pick up one or two benign outcomes, such as April 1999 (which I noted in the Hazardous Ovoboby piece in early 2007), but ask whether, on average, you would have knowingly chosen to take market risk at those points.

2) Agreement among "experts" is not your friend

“Tarnished! Nobody expects gold prices to turn up soon: It's difficult to find any positive news in the depressed gold market. At around $260 an ounce, the metal continues to trade near its cost of production, and almost no one believes it will rally soon. ‘Financing is tough to come by these days' in the unpopular gold-mining sector, says Ferdi Dippenaar, Harmony's director of marketing. ‘Unfortunately, there is nothing positive on the horizon.'”

Barron's Magazine, Commodities Corner: February 12, 2001

"Not a Bear Among Them"

Barron's Investment Roundtable, December 1972 (at the beginning of a 50% market plunge - No intent to pick on Barron's - they've just been around the longest, so we have lots of back-issues)

Barron's Investment Roundtable, December 1972 (at the beginning of a 50% market plunge - No intent to pick on Barron's - they've just been around the longest, so we have lots of back-issues)

"Wall Street Heavyweights Agree: Time to Get Back Into Stocks!"

USA Today Investment Roundtable, December 2010

3) Downside risk tends to be elevated precisely when risk premiums and volatility indices reflect the most complacency

I could go on, but nobody cares.

4) We did not avoid a second Great Depression because we bailed out financial institutions. Rather, the collapse in the economy and the surge in unemployment were the direct result of a gaping hole in the U.S. regulatory structure that prevented the rapid restructuring of insolvent non-bank financials. Policy makers then inappropriately extended the "too big to fail" doctrine to ordinary banks. Following a striking loss of public confidence that resulted from arbitrary policy responses, coupled with fear-mongering by exactly those who stood to benefit from public handouts, the self-fulfilling crisis was contained by a change in accounting rules that effectively disabled capital requirements for all financial companies. We are now left with a Ponzi scheme.

While it's clear that the four-second tape in Ben Bernanke's head is an endless loop saying "We let the banks fail in the Great Depression, and look what happened," any disruption caused by the "failure" of a financial institution is not due to financial losses to bondholders, but is instead due to the necessity of liquidating the assets in a disorganized, piecemeal way, as was the case with Lehman Brothers. Large, sometimes major banks fail every year without a material effect on the economy. The key is to have regulations that allow these failures to occur with the minimal amount of disruptive liquidation.

It is important to recognize that nearly every financial institution has enough debt to its own bondholders on the balance sheet to absorb all of its losses without any damage to depositors or customers. These bondholders lend at a spread, and they knowingly take a risk.

Bank regulations intelligently allow the FDIC to cut away the "operating" portion of a financial institution from the obligations to its bondholders and stockholders. Consider a bank with $100 billion of assets, against which it owes $60 billion of customer deposits, $30 billion of debt to its own bondholders, and $10 billion in shareholder equity. Now suppose those assets decline in value to just $80 billion, creating an insolvent institution ($80 billion in assets, $60 billion in deposit liabilities, $30 billion in debt to bondholders, and -$10 billion in equity). The "operating portion" is the $80 billion in assets, along with the $60 billion of customer deposits, which can be sold as a "whole bank" transaction for $20 billion to another institution. The stockholders are wiped out, while the bondholders get the $20 billion residual and take a loss on the rest. Depositors and customers now get statements with a different logo at the top. The seamless "failure" of Washington Mutual is a good example of this in action.

The problem with Bear Stearns and Lehman was that no equivalent set of regulations was in place to allow "cutting away" the operating portion of a non-bank institution. Instead, the Fed illegally expanded the definition of the word "discount" in Section 13(3) of the Federal Reserve Act and created a shell company to buy $30 billion of Bear Stearns' questionable long-term assets without recourse. The remaining entity was sold to JP Morgan, where Bear Stearns bondholders still stand to get 100 cents on the dollar plus interest. Lehman was allowed to "fail," but because there was still no set of regulations that allowed cutting away the operating entity, it had to be liquidated piecemeal.

Importantly, and even urgently, it was not this "failure" that produced the economic downturn. If you carefully observe what happened in 2008, the large-scale collapse of the financial markets and the U.S. economy started literally sixty seconds after TARP was passed by Congress on October 3, 2008. At that moment, the world was told not that the smooth operation of the global financial system would be ensured by taking receivership of failing financial institutions; not that the focus of policy would be the protection of depositors, customers, and U.S. fiscal stability; but instead that insolvent private balance sheets would now be defended, subject to the arbitrary decisions of policy makers in which nobody had confidence. Lehman's failure simply told investors that these decisions could be completely arbitrary, since there was really no operative distinction between Bear Stearns, which was saved, and Lehman, which was not. Moreover, in order to pass TARP, the public had to be convinced that a global meltdown would result if financial institutions weren't preserved in their existing form. In this way, policy makers created a crisis of confidence.

Skip forward and carefully observe what happened in 2009, and you'll see that the crisis was suspended once the FASB threw out rules requiring financial companies to report their assets at market value, while at the same time, the Federal Reserve illegally broadened the definition of "government agency" in Section 14(b) of the Federal Reserve Act in order to purchase $1.5 trillion of Fannie Mae and Freddie Mac obligations. These actions replaced the arbitrary discretion of policy makers with confidence that no major institution would be at risk of failing because, in effect, meaningful capital standards would no longer apply.

Thus, our policy makers first created a crisis of confidence, and then resolved it by legalizing a global Ponzi scheme.

As David Einhorn at Greenlight Capital has noted, "We learned the wrong lesson." We should have learned that existing capital standards were insufficient and that there was a large, gaping hole in our regulatory structure that failed to provide "resolution authority" for non-bank financial companies. Instead, we've learned the dangerously misguided notion that some institutions are simply too big to fail. This inevitably creates a situation where reckless misallocation of capital continues to be subsidized at increasing public cost, while bondholders go unscathed and insiders take bonuses with the same alacrity as Bernie Madoff's early investors.

In short, the downturn in the real economy occurred because regulators refused to take receivership of insolvent institutions, while pushing a story line that the entire global economy would crumble if bondholders had to take losses. This created a fear among depositors and consumers that the entire system was arbitrary and unstable, fueled periodic runs on various financial institutions, tightened the availability of credit to companies having nothing to do with real estate, and created a self-fulfilling prophecy of global economic weakness. Had our policy makers said "depositors and customers will be protected, we will immediately exercise resolution authority over insolvent institutions, and bondholders will not be spared" we could have simply had a "writeoff recession" in paper assets, rather than an implosion of the real economy and an explosion in public debt.

The facts simply do not support the idea that taking receivership of insolvent financials leads to economic distress. Rather, it properly rests losses on the bondholders, and preserves the operation of the financial system by bolstering its solvency. One might argue that we could not possibly let bondholders take the trillions of dollars of losses that would have been required in order to restructure debt and get the bad obligations off the books. This is absurd. A 20% stock market decline wipes out about $3 trillion in market value. Indeed, given the size and average maturity of the U.S. bond market, just the increase in interest rates that we've observed over the past 6 weeks has knocked off trillions in market value.

The financial markets are perfectly capable of taking losses. They don't do well with disorganized piecemeal liquidation - where perfectly good loans are called in and countless positions have to be unwound - but that isn't required if your regulatory structure allows receivership/conservatorship that can cut away and gradually transfer the operating portion of an institution. What the global economy is not capable of taking is the uncertainty that results when policy makers apply arbitrary rules, leaving all other decision makers in the economy frozen at the edge of their seats to discover what the results of those arbitrary decisions will be. We have learned the wrong lesson, and we continue to pay for it.

5) The U.S. economy is recovering, but that recovery is vulnerable to even modest shocks.

As I noted a couple of weeks ago, in the ideal case where the economy grows continuously without further credit strains, the "mean-reversion benchmark" scenario would be for GDP growth to approach an average rate of 3.8% annually for about 4 years, followed by about 2.3% annual growth thereafter. The corresponding mean-reversion benchmark for employment growth would be an average of about 200,000 new jobs per month on a sustained basis.

There has certainly been some improvement in various indicators of economic activity. As strange as this may sound, given my criticism of the Fed, I would attribute much of this improvement to a sentiment effect in response Fed's policy of quantitative easing. While long-term Treasury yields are significantly higher than before QE2 was announced, and though I continue to believe that the main effect of QE2 has been to encourage ultimately short-sighted speculation, the Emperor's-clothes enthusiasm about QE2 has had at least the short-term effect of buoying short-term spending and hiring plans. Unfortunately, this sort of sentiment-dependent bounce in activity is not very robust to shocks.

So while the surface activity of the U.S. economy has observably improved, it is in the context of an overvalued, overbought, overbullish, rising-yields market that is vulnerable to abrupt losses, a global financial system that remains subject to strains from sovereign default, a housing market where one-in-seven mortgages is delinquent or in foreclosure, and nearly one-in-four is already underwater with a huge overhang of unliquidated foreclosure inventory still in the pipeline, and a domestic financial system that lacks transparency and may still be slouching toward insolvency. The U.S. economy is progressing on the surface, but it remains a house built on a ledge of ice.

6) The U.S. fiscal position is far worse than our present $1.3 trillion deficit and nearly 100% debt/GDP ratio would suggest.

On the deficit side, there is certainly a "counter-cyclical" pattern to the U.S. federal deficit. As I noted a few weeks ago, every 1% shortfall of real GDP from potential (as estimated by the CBO) tends to be associated with a roughly 0.67% increase in the deficit as a percentage of potential GDP. So it is certainly true that part of the existing deficit reflects normal "automatic stabilizers." Unfortunately, this only explains about half the present deficit. Moreover, in order to adequately evaluate the existing deficit, it is essential to recognize that this figure reflects interest costs that are dramatically less than we can expect as a long-term norm. Consider the chart below. The blue line represents interest on the gross Federal debt at the average of prevailing 10-year Treasury yields and 3-month Treasury yields. Presently, this figure is comfortably low, thanks to the depressed level of interest rates. In contrast, the red line shows what the interest service would be at a 5.2% interest rate, which is the post-war norm.

Even if we restrict the analysis to publicly-held debt, the interest service at a 5.2% rate would still easily approach $500 billion annually. Investors and policy-makers risk an unpleasant surprise if they do not factor the unusually low level of interest rates into their evaluation of present fiscal conditions.

7) A long period of generally rising interest rates will not negate the ability of flexible investment strategies to achieve returns, provided that the increase in rates is not diagonal, and the strategy has the ability to vary its exposure to interest rate risk.

One of the most frequent questions received by shareholder services is what investors should expect if the "great bond bull" is now over. From my perspective, the answer is straightforward - we can't squeeze water from a stone if interest rates advance diagonally and persistently, but they rarely do. Provided that we observe natural cyclical fluctuation in yields, I expect that we'll have sufficient opportunities to vary our exposure in the event that yields advance over time.

Without detailing our own investment approach, which classifies Market Climates based on the level and pressure on bond yields, even a very simple model will suffice to demonstrate the point. Below, I've charted the total return of buy-and-hold strategy using 10-year Treasury debt, compared with the total return from a variant of a simple switching method described by Mark Boucher. The model is long when the 10-year Treasury yield is below its 10-week average and either the Dow Utility average is above its 10-week average or the 3-month Treasury yield is below its 50-week average.

The chart shows the period from 1963 to 1983 which captures the steepest interest rate increase in U.S. history. It isn't a performance claim, and the model is overly simplistic to follow in practice - it's too binary (i.e. either in or out) and trades too frequently to be effective as a stand-alone strategy. Still, the signal itself is clearly a useful indicator. Again, the basic point is that as long as yields don't rise in a perpetual diagonal line, strategies with the flexibility to vary interest rate exposure can perform admirably over time.

8) Stocks are a poor inflation hedge until high and persistent inflation becomes fully priced into investor expectations. At the same time, short-dated money market debt has historically been a very effective inflation hedge.

Investors sometimes make the mistake of believing that since nominal earnings can be expected to grow during periods of inflation, stocks should be a good inflation hedge. Straightforward reasoning, but unfortunately, it's not true. Sustained periods of inflation are disruptive, so even during the period between 1960 and 1980, S&P 500 nominal earnings still did not accelerate from their normal 6% peak-to-peak long-term growth rate. Moreover, stocks only behave as a good inflation hedge after high inflation is already fully anticipated. During the transition from low inflation to high inflation, stock prices have historically provided awful returns.

In contrast, short-term Treasury securities have historically been quite good inflation hedges. This is because short-term interest rates quickly adjust to reflect prevailing inflation rates, so unless you get a period of persistently negative real interest rates, the strategy of staying relatively liquid in interest-bearing securities has been fairly effective. It is certainly true that non-interest bearing cash is ineffective in preserving real purchasing power during a period of inflation, but the same is not true for short-dated money market securities.

9) It will be harder to inflate our way out of the Federal debt than investors seem to believe.

This is a corollary to 8). A significant portion of the U.S. Treasury debt is represented by short-duration paper, which makes the U.S. far more sensitive to rollover risk, and also makes the value of the debt less sensitive to inflation. See, if you borrow funds for 30 years, you can turn around and create a massive inflation to diminish the real value of that debt. But if you've borrowed funds for a year and then create a massive inflation, you'll find that investors will require a higher interest rate on the debt next year, which prevents the obligation from being diminished over time. This is good for the investors, but bad for the Federal government.

10) It will be harder to grow our way out of the Federal debt than investors seem to believe

This is simple algebra. A reduction in the ratio of debt to GDP - even assuming a balanced budget - requires the growth rate of nominal GDP to exceed the interest rate on the debt. Equivalently, real GDP growth has to exceed the real interest rate on the debt. Historically, 10-year Treasury yields have exceeded inflation in the GDP deflator by about 2.6% annually, while 3-month Treasury yields have averaged about 1.2% over inflation in the GDP deflator. The CBO estimates the probable growth of potential GDP to be about 2.3% over the coming 20 years. At best, and even assuming immediate budget balance, this economic growth would bring down the ratio of debt to GDP by no more than 1% annually.

11) Based on a variety of valuation methods that have a strong historical correlation with subsequent long-term market returns, we estimate that the S&P 500 is presently priced to achieve a total return averaging just 3.6% annually over the coming decade.

We would have a different expectation if other competing methods (such as the Fed model) had a better record of accuracy, but we do not observe this. The decade of negative returns following the market peak in 2000 was entirely predictable. Presently, we have a market that is priced to achieve the weakest 10-year return of any period prior to the late 1990's market bubble. Still, stocks were more overvalued at the 2007 peak than they are today, and were certainly more overvalued in 2000. Both of those peaks were followed by declines that cut prices in half. The current overvalued, overbought, overbullish, rising yields combination compounds the headwinds for the market here, but nothing is certain, and we can't rule out further speculation on hopes of ever larger government distortions.

Despite these valuations, we are willing to adopt moderate, periodic exposure to market fluctuations at points that we clear overbought and overbullish conditions, provided that market internals do not clearly break down in the process. We may see this opportunity in a few weeks, or a few months, but we do not observe it here. For now, we remain tightly defensive.

12) The specific features of a given economic cycle don't change the mathematics of long-term returns - they simply affect the level of valuation that investors demand or are willing to temporarily tolerate.

At the 2000 bubble peak, and again at the 2007 peak, and again today, we received notes asking whether factors such as the internet, or the emergence of China, or the level of interest rates, or Fed intervention somehow had created a world that was "different this time" in a way that made historical analysis inapplicable. From my perspective, the answer in each case is "no."

It's certainly true that the enthusiasm about the internet and other new technologies, coupled with years of uninterrupted, low-volatility economic growth, encouraged investors to tolerate far higher valuations in 2000 than history had ever witnessed. Yet this still did not change the longer-term algebra, which indicated correctly that stocks were likely to produce negative returns over the following decade. Likewise, the emergence of China as a major economic power did not prevent the market from losing well over half of its value from 2007 to 2009.

Indeed, even in early 2009, the valuation mathematics briefly suggested that stocks were priced to achieve 10-year total returns averaging just over 10%. My concern at that time was not that stocks were overvalued. Rather, history indicated that following periods of major credit strains in the U.S. and internationally, investors had typically demanded far greater prospective returns as compensation for the risk. On that assessment, I was clearly wrong, as the actions of the FASB, Fed and Treasury encouraged a quick resumption of speculation. Still, none of this threw the mathematics of long-term returns out the window. It simply compressed a good portion of those prospective 10-year returns into a 2-year window, so that we would estimate the probable total returns for the S&P 500 over the coming 8 years at roughly 3% annually.

In short, it's not impossible that specific features of the current market could make investors more tolerant of rich valuations, or more careful to demand conservative ones. Regardless, my impression is that a decade from today, investors will view the present time as a relatively undesirable moment to put investment capital at risk.

http://www.hussman.net/wmc/wmc101220.htm

http://www.hussman.net/wmc/wmc101220.htm

Labels:

Economy

Monday, December 27, 2010

David Rosenberg's Forecast for 2011

By David Rosenberg - December 24th, 2010, 9:00AM

1. In Barron’s look-ahead piece, not one strategist sees the prospect for a market decline. This is called group-think. Moreover, the percentage of brokerage house analysts and economists to raise their 2011 GDP forecasts has risen substantially. Out of 49 economists surveyed, 35 say the U.S. economy will outperform the already upwardly revised GDP forecasts, only 14 say we will underperform. This is capitulation of historical proportions.

The last time S&P yields were around this level was in the summer of 2000, and we know what happened shortly after that.

2. The weekly fund flow data from the ICI showed not only massive outflows, but in aggregate, retail investors withdrew a RECORD net $8.6 billion from bond funds during the week ended December 15 (on top of the $1.7 billion of outflows in the prior week). Maybe now all the bond bears will shut their traps over this “bond-bubble” nonsense.

3. Investors Intelligence now shows the bull share heading up to 58.8% from 55.8% a week ago, and the bear share is up to 20.6% from 20.5%. So bullish sentiment has now reached a new high for the year and is now the highest since 2007 ― just ahead of the market slide.

4. It may pay to have a look at Dow 1929-1949 analog lined up with January 2000. We are getting very close to the May 1940 sell-off when Germany invaded France. As a loyal reader and trusted friend notified us yesterday, “fighting” war may be similar to the sovereign debt war raging in Europe today. (Have a look at the jarring article on page 20 of today’s FT — Germany is not immune to the contagion gripping Europe.)

5. What about the S&P 500 dividend yield, and this comes courtesy of an old pal from Merrill Lynch who is currently an investment advisor. Over the course of 2010, numerous analysts were saying that people must own stocks because the dividend yields will be more than that of the 10-year Treasury. But alas, here we are today with the S&P 500 dividend yield at 2% and the 10-year T-note yield at 3.3%.

From a historical standpoint, the yield on the S&P 500 is very low ― too low, in fact. This smacks of a market top and underscores the point that the market is too optimistic in the sense that investors are willing to forgo yield because they assume that they will get the return via the capital gain. In essence, dividend yields are supposed to be higher than the risk free yield in a fairly valued market because the higher yield is “supposed to” compensate the investor for taking on extra risk. The last time S&P yields were around this level was in the summer of 2000, and we know what happened shortly after that. When the S&P yield gets to its long-term average of 4.35%, maybe even a little higher, then stocks will likely be a long-term buy.

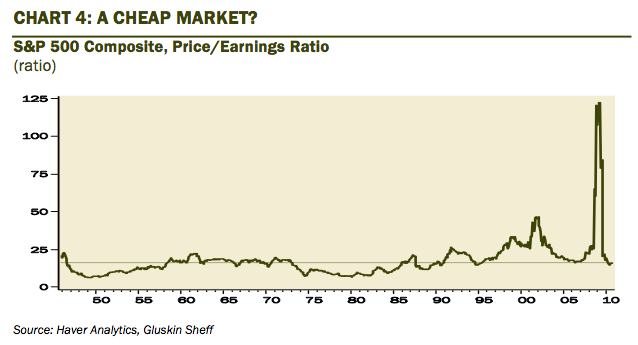

Source: Haver Analytics, Gluskin Sheff

6. The equity market in gold terms has been plummeting for about a decade and will continue to do so. When measured in Federal Reserve Notes, the Dow has done great. But there has been no market recovery when benchmarked against the most reliable currency in the world. Back in 2000, it took over 40oz of gold to buy the Dow; now it takes a little more than 8oz. This is typical of secular bear markets and this ends when the Dow can be bought with less than 2oz of gold. Even then, an undershoot could very well take the ratio to 1:1.

7. As Bob Farrell is clearly indicating in his work, momentum and market breadth have been lacking. The number of stocks in the S&P 500 that are making 52-week highs is declining even though the index continues to make new 52-week highs.

8. Stocks are overvalued at the present levels. For December, the Shiller P/E ratio says stocks are now trading at a whopping 22.7 times earnings! In normal economic periods, the Shiller P/E is between 14 and 16 times earnings. Coming out of the bursting of a credit bubble, the P/E ratio historically is 12. Coming out of a credit bubble of the magnitude we just had, the P/E should be at single digits.

Source: Haver Analytics, Gluskin Sheff

9. The potential for a significant down-leg in home prices is being underestimated. The unsold existing inventory is still 80% above the historical norm, at 3.7 million. And that does not include the ‘shadow’ foreclosed inventory. According to some superb research conducted by the Dallas Fed, completing the mean-reversion process would entail a further 23% decline in real home prices from here. In a near zero percent inflation environment, that is one massive decline in nominal terms. Prices may not hit their ultimate bottom until some point in 2015.

10. Arguably the most understated, yet significant, issue facing both U.S. economy and U.S. markets is the escalating fiscal strains at the state and local government levels, particularly those jurisdictions with uncomfortably high pension liabilities. Have a look at Alabama town shows the cost of neglecting a pension fund on the front page of the NYT as well as Chapter 9 weighed in pension woes on page C1 on WSJ.

Consumer spending was taken down 0.4 of a percentage point to 2.4%, which of course you never would have guessed from those “ripping” retail sales numbers.

In the absence of Chapter 9 declarations or dramatic federal aid, fixing the fiscal problems at lower levels of government is very likely going to require some radical restraint, perhaps even breaking up existing contracts for current retirees and tapping tax payers for additional revenues. The story has some how become lost in all the excitement over the New Tax Deal cobbled together between the White House and the lame duck Congress just a few weeks ago.

Labels:

Economy

Sunday, December 26, 2010

Mish's Ten Economic and Investment Themes for 2011

1. US Municipal Bankruptcies Head to Center Stage

Look for Detroit and at least one other city in Michigan to go bankrupt. Also look for increasing discussions regarding bankruptcy from Los Angeles, Miami, Oakland, Houston, and San Diego. Those cities are definitely bankrupt, they just have not admitted it yet. The first major city to go bankrupt will cause a huge stir in the municipal bond market. Best to avoid Munis completely.

2. Sovereign Debt Crisis Hits Europe

The ECB and EU are hoping things return to normal and they can deal with things more calmly in 2013. The markets will not wait. Expect a new Parliament in Ireland to want to renegotiate whatever horrendous deal Prime Minister Brian Cowen agrees to. Portugal and Spain will need bailouts. The surprise play in Europe will be Italy, a country not on anyone's front burner. Italy will come under intense credit market pressure, and when it does the whole Eurozone comes unglued. Europe's banks are insolvent and ECB president Jean-Claude Trichet will have a choice, haircuts or massive printing.

3. Cutbacks in US Cities and States

With Republican governors holding a majority of governorships, with Republicans holding a majority in the House, and with a far more conservative Senate, there is going to be little enthusiasm for increasing aid to states. There will be some aid to states of course, but nowhere near as much as needed to prevent cutbacks. Expect to see a huge number of layoffs and/or cutbacks in services. Cutbacks in cities and states will be a good thing, but that will counteract other gains in employment. The unemployment rate will stay stubbornly high.

4. Public Unions Under Intense Attack

Public unions will face increasing hostility, not only in the US but also the Eurozone and UK. Look for Congress to consider legislation to kill collective bargaining. If it passes, the president would veto it. The problem however will not go away. Cities and states in distress will increasingly outsource every contract they can.

5. China Overheats, Multiple Rate Hikes Coming

China, everyone's favorite promised land, has a hard landing. China will grow at perhaps 5-6% but that is nowhere near as much as China wants, or the world expects. Tightening in China will crack its property bubble and more importantly pressure commodities. The longer China holds off in tightening, the harder the landing.

6. Property Bubble Bursts Wide Open in Australia and Canada

Australia, having largely avoided the global recession runs out of luck this time around. Look for the Australian economy to fall into outright recession. Look for Canada to slow dramatically as its property bubble pops. The US property bubble is much further progressed, by years, than Australia, Canada, and China. This matters immensely.

7. US Avoids Double Dip

The tax cut extensions and the payroll tax decrease will keep the US out of recession. However, growth estimates are still too high. The tax cut extensions do nothing more than maintain the status quo while the payroll tax deduction is just for a year. Most will use it to pay down bills. Look for GDP at 2.0-2.5%. That is the stall rate.

8. Year That Something Matters

For the global equity markets, this will be the year that something matters. Certainly nothing mattered in 2010, and optimism for equities is at extreme levels. I have no targets other than a suggestion this is an extremely poor time to invest in darn near anything.

9. Decoupling in Reverse

I do not think any countries decouple in 2011, including China. However, on a relative basis, the US could. Europe is a basket case, China is overheating, Australia is headed for recession, the UK is going nowhere, and 2.0-2.5% growth in the US just might look damn good compared to anything else. Bear in mind far more than 2.0-2.5% US growth is priced in, but on a relative basis that is likely to smash the performance of the Eurozone, Australia, and Canada. China may grow 5.0-6.0% but with 10% priced in, overweight China, the emerging markets and the commodity producing countries is a serious mistake. Actually, equities are a mistake in general and so are commodities. Finally, falling commodity prices would be US dollar supportive and supportive of a decreasing US trade deficit as well, especially if grain prices stay high while oil sinks. Should grains stay firm while other commodities sink, it would help boost US GDP.

10. US Dollar to Strengthen

Look for the US dollar to strengthen because of the net effect of all the above issues.

Relative Performance Examples

On a relative but not absolute basis I like the US. On a currency adjusted basis I especially like Japan. Here is a hypothetical example: Should foreign equities drop 20% and the US dollar strengthen 10% the loss to US investors would be 30%. Should Foreign investors buy US equities and face a loss of 20% and a 10% rise in the dollar, they would see a 10% loss. US investors of course would see the full 20% loss. Japan looks attractive in nominal terms but strengthening of the dollar compared to the Yen could negate some if not all of that. Equities in general, with the possible exception of Japan do not look attractive.

Miscellaneous Issues

The order in which the above themes play out could be important. If a muni crisis hits the US before a sovereign crisis in the Eurozone and a slowdown in China, the dollar may not initially perform as expected. Similarly, if the US strengthens more than expected in the first quarter while Europe and China stagnate, another leg down in treasuries may be in store with the US dollar quickly blasting higher.

I have no firm conviction for gold, silver, or US treasuries other than gold is likely to hold its own and then some should the ECB decide to print its way out of this mess.

US treasuries are now in no-man's-land dependent on the order of things and the reactions of foreign central banks as the crisis plays out. Seasonally, treasuries are generally weak until June (think tax purposes). However, there are so many factors now, including Fed purchases, it is hard to estimate.

2010 was a lull in the global economic crisis. Don't expect 2011 to be the same. Something, indeed many things, are likely to matter in 2011.

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Labels:

Economy

Saturday, December 25, 2010

Friday, December 24, 2010

Thursday, December 23, 2010

Wednesday, December 22, 2010

Tuesday, December 21, 2010

Are the central banks running a fractional gold system?

16 December 2010by Alisdair McCleodThis thought is prompted by a forensic study of the Bank for International Settlements’ records and accounting procedures with respect to its dealings in gold, which was presented by Robert Lambourne to the Gold Symposium in Sydney on 9th November. The link to his report is here. Lambourne points out that the BIS was founded in 1930, when settlements between central banks routinely involved gold, and the primary function of the BIS was to facilitate these settlements without the physical transfer of bullion. This involved gold accounts being maintained at the BIS for gold owned by central banks, with other central banks at the main depository centres. Lambourne cites the example of the pre-war German Reichsbank, which held gold through the BIS in Amsterdam, Berne, Brussels, London and Paris.Central banks were offered two different types of account at the BIS, earmarked and sight: earmarked accounts recorded gold held separately and specifically for a central bank, and sight accounts were non-specific. Earmarked gold is allocated, while sight gold is unallocated; earmarked is custodial and sight is co-mingled.The flexibility of the system allowed a central bank to diversify its gold reserves in a number of centres through a politically neutral institution, and it made sense to allocate some of this into a fungible account to settle transactions with other central banks. But that was pre-war, and before the US, with the co-operation of the IMF and other European central banks, demonetised gold.Today, the BIS still operates earmarked and sight accounts for central banks, but crucially, rather than have the bulk of gold in earmarked accounts with a smaller float in fungible sight accounts, the bulk of central bank gold is now held in unallocated sight form. Lambourne brings this point out in his analysis of the 2009/10 BIS Annual Report, which shows in Note 32 that the BIS holds only 212 tonnes for central banks in earmarked accounts, and 1,704 tonnes on its balance sheet in sight accounts. Furthermore, the BIS accounts disclose that almost all of the 1,704 tonnes is held at central banks in unallocated sight form. This confirms that the central banks themselves also operate sight accounts.So to summarise so far, out of 1,912 tonnes at the BIS, 90% of it is now unallocated and nearly all of this gold is held in unallocated accounts at other central banks. While this sight gold at central banks is technically deliverable on demand, there is no apparent requirement for them to actually have it. It is therefore entirely possible for a central bank to retain only a small portion of the total owed on sight accounts, which after all is what banks have done from time immemorial.The temptations to use physical gold from these unallocated sight accounts to supply the market have been enormous, given the progressive demonetisation and discreditation of gold by the BIS founder members. It is easy, without proper audits, to keep these activities secret from the markets and even from other central banks not in the inner circle. It would be very interesting to know, for example, the terms under which India agreed to buy 200 tonnes of gold from the IMF. Did she actually take delivery into an earmarked account, or was it a pure paper transaction across sight accounts? If she had insisted on an earmarked account, would the deal have gone to someone less picky? Was the IMF gold itself earmarked or sight, existing or non-existent? As an outsider from the inner BIS circle the Bank of India is not in a position to suspect she may be the victim of a pyramid scheme run by her superiors; nor indeed is any other of the minor central banks with sight accounts in London, New York or Zurich.We must hope for the sake of financial stability that such suspicions are without foundation, but this hope is untenable while the major note-issuing banks refuse to provide independent audits of their activities. If these central banks have been operating a fractional sight system, then it could explain how they have managed to supply so much bullion into the markets while appearing to maintain their official reserves.China and Russia must be watching this with great interest. We can assume that their intelligence services are more aware of the true position than the general public, and if they also conclude that the Western central banks are running a fractional system using sight accounts, this knowledge hands them great economic power.It is relevant to bear this in mind, because it will condition the US’s response to what is developing into a destructive gold crisis. Political and strategic considerations will have to be weighed as well as purely financial and practical ones. It would be downright stupid, for example, for the US to confiscate privately owned gold, without international agreement from Russia China and India as well as the Europeans to take similar action. And how co-operative would any nation be when they discover that the gold they thought they had at the BIS, the Fed and the Bank of England has actually vanished?This is important because the basic problem is that government and banking debt around the world are both rapidly moving towards default, and since governments are guaranteeing the lot, the pace of monetary creation is accelerating. The consequence is that the gold suppression schemes, which have existed for the last one hundred years in one form or another, are finally coming to an end. We are trying to guess how dramatic that end will be. It will be difficult enough to stop a run by unallocated account holders on the bullion banks, without forcing a cash-payout amnesty. But if the central banks themselves cannot supply the necessary bullion to prevent this, the prospect of a total collapse of paper money will be staring us all in the face.

http://www.financeandeconomics.org/Articles%20archive/2010.12.16%20BIS.htm

Labels:

Central Banks,

Gold

Monday, December 20, 2010

Argentin, Gewiss, The Fleche Wallone Miracle, and Dr. Michele Ferrari

I was sitting in the BMW dealership negotiating my new car purchase with fellow cyclist and car salesman Mike Shaddock, when Mike went to discuss the deal with his manager.

While waiting for him to return, I started surfing on my iPhone and went to the Cycling News website. Where I found the following article. Which I thought was a bit odd. While Argentin is railing about individuality, lack of panache, specialization and cycling as a business, it is with the overlay of the Contador controversy of being positive for Clenbuterol. So, it made me pause and think about Argentin, wasn't he part of the original and infamous Gewiss team? See the following story from CN.

Former world champion describes riders as spineless

While waiting for him to return, I started surfing on my iPhone and went to the Cycling News website. Where I found the following article. Which I thought was a bit odd. While Argentin is railing about individuality, lack of panache, specialization and cycling as a business, it is with the overlay of the Contador controversy of being positive for Clenbuterol. So, it made me pause and think about Argentin, wasn't he part of the original and infamous Gewiss team? See the following story from CN.

Former world champion describes riders as spineless

Former world champion and classics winner Moreno Argentin has blasted the UCI, modern day riders and especially Alberto Contador for their lack of character, describing them as spineless and soft. He blasts the UCI for running a fake form of democracy, suggesting they are only interested in turning the sport into a business.

Argentin won the world title in Colorado Springs in 1986 and is still the most successful Italian rider in Belgium classics thanks to winning a Tour of Flanders, four editions of Liege-Bastogne-Liege and three editions of Fleche Wallonne.

He raced for 14 years between 1981 and 1994, retiring after wearing the pink jersey at the Giro d’Italia for two days.

He was part of the dominant Gewiss team in that final year that also included Giro winner Evgeni Berzin and Milan-San Remo winner Giorgio Furlan. They completed the podium with Argentin at Fleche Wallonne in 1994 after breaking away from the peloton together.

Argentin has never been afraid to speak about his close relationship with Dr Michele Ferrari in the final part of his career and has defended the Italian doctor’s methods and links to Lance Armstrong.

“I have to thank my parents that I was born when I was. I was born hungry. Now the guys seem soft without any character,” Argentin toldGazzetta dello Sport.

“A lot of people aren’t hungry for success and they’ve already earned a lot since they were a junior. I suppose things have changed and it’s a different generation that already has everything. That’s why when I watch races there seems to be a total lack of emotion. There aren’t any riders that get you excited these days.”

“Contador is a carefully calculated racing machine, made in a laboratory for one race: the Tour. It doesn’t seem to matter if he’s got personality or not. He and Schleck are the same. You know how they’re going to race; you know where to wait for them to do something. They haven’t got any originality.”

“Indurain dominated the grand tours in my time but I beat him at Liege-Bastogne-Liege. And he also rode Milan-San Remo because he understood the history of the sport. Now the riders are all robots. Punctures and crashes are part of the sport. But with radios the riders seem to be controlled by a joystick. The whole sport is in a mess.”

A fake form of democracy

Argentin initially stayed in cycling when he retired but now owns a successful construction company in the northeast of Italy. He hopes to build a velodrome and training centre in the Dolomites.

“I’m happy not to be involved in cycling anymore. These days if you don’t accept things, you can’t survive. I prefer to listen to my own conscience.”

“These days the only thing that seems to matter is the UCI and its business. The sponsors and riders don’t seem have the right to say anything. There’s a fake form of democracy in cycling and no desire to change things. The track is dead and buried and the road is going the same way.”

“The Giro, the Tour and the monumental classics are the races that matter; they’re the history of the sport and get the people out along the roadside to watch them. But the UCI is bringing everything down to a same level. That’s why they went to war with the Giro and Tour organisers.”

“Look how the rules, points and classifications have changed. It’s about income and business. The sponsors bring the cash and pay the riders but can’t have their say. They deserve more respect.”

The riders are spineless

Argentin calls on the riders to speak out, using Franco Pellizotti’s refusal to speak out about biological passport case as an example of how the riders are afraid to challenge authority and rock the boat.

“The riders are spineless. They know that if they speak out they never race again,” he said.

“Look at Pellizotti. I met him the other day. He lost the whole season because of his suspicious blood values but won’t say anything, otherwise…”

“The riders have to stop and rewrite the rules that are strangling them. From the points system to the anti-doping rules. The whereabouts system makes them seem criminals on bail. They’re unable to work together and think of the future. I was a pro for 14 years but these days how many off them reach half of that?”

------------------

Now here is the story I vaguely recalled written up as one of the ten most amazing cycling races. Three guys from one team rode away from the Peloton. This is unprecedented, to let more than one guy from a single team get away, let alone three guys. No way. The peloton could not reel them in - the whole peloton going full gas could not do it. Say, welcome to the sport EPO combined with some exceptional training techniques.

The 1994 Fleche Wallone raised eyebrows, not for the winner, Italian Moreno Argentin, 'king of the Ardennes' Classics but for the actual manner in which the race unfolded. Argentin and two of his Gewiss team-mates, Evgeni Berzin & Giorgio Furlan simply rode away from the rest of the peloton with 50 km remaining to finish 1-2-3 at the finish on the Mur du Huy.

------------------

Now here is the story I vaguely recalled written up as one of the ten most amazing cycling races. Three guys from one team rode away from the Peloton. This is unprecedented, to let more than one guy from a single team get away, let alone three guys. No way. The peloton could not reel them in - the whole peloton going full gas could not do it. Say, welcome to the sport EPO combined with some exceptional training techniques.

It was unprecedented for a team to dominate one of the toughest and hilliest 'classic' races on the calendar in such a manner.

The Gewiss team were looked after by Dr. Michael Ferrari and it was after this race that he made his famous comment about EPO being no more dangerous than orange juice. The Gewiss team would dominate the 1994 season and with the benefit of hindsight, this race was perhaps the defining moment of the EPO generation.

----------------------

And then there's this. I just stumbled across this article published on Scribd. I have only heard bits and pieces about the trial of Michele Ferrari. This fills in many of the blanks. He drained the local pharmacy of their supply of EPO. Very interesting read...

Paging Dr Ferrari

And then there's this. I just stumbled across this article published on Scribd. I have only heard bits and pieces about the trial of Michele Ferrari. This fills in many of the blanks. He drained the local pharmacy of their supply of EPO. Very interesting read...

Paging Dr Ferrari

by Bill Gifford on Scribd...

-------------------------

Look at Michele Ferrai's website. Some really good info there on training techniques. The man is a genius with regard to sport physiology.

-------------------------

Look at Michele Ferrai's website. Some really good info there on training techniques. The man is a genius with regard to sport physiology.

...for some really good training

Labels:

cycling

Subscribe to:

Posts (Atom)