Friday, February 28, 2014

Thursday, February 27, 2014

Bush cyberczar: NSA created ‘the potential for a police state’

February 25, 2014 19:02

The former cyber advisor under President George W. Bush had some harsh words for the United States National Security Agency during an address in California on Monday: "get out of the business of fucking with encryption standards.”

That was the recommendation that famed cyberczar Richard Clarke made while speaking earlier this week at the at the Cloud Security Alliance summit in San Francisco.

Clarke, 63, served as a counterterrorism advisor for President Bill Clinton in the 1990s and later assisted his successor, Mr. Bush, as the special advisor on cybersecurity for that administration through 2003. Most recently, though, Clarke was assigned to a five-person panel assembled by Pres. Obama late last year that was tasked with assessing the NSA’s operations in the midst of ongoing and ever-damagingleaks disclosed by former intelligence contractor Edward Snowden. In December, that group suggested 46 changes for the Obama administration to consider in order rein in the secretive spy agency.

Speaking during Monday’s conference, however, Clarke opened up about some of the more personal suggestions he has for the NSA, and even some insight about what the future may have in store for the agency if they continue to collect intelligence from seemingly all corners of the Earth.

"In terms of collecting intelligence, they are very good. Far better than you could imagine," Clarke said."But they have created, with the growth of technologies, the potential for a police state."

"If you're not specific, an agency that bugs phones is going to bug phones," he added, according to the Tech Target blog, Search Security. "The NSA is an organization that's like a hammer, and everything looks like a nail."

Even if the NSA scales back such hacking operations in the future as Pres. Obama suggested and limits who the US targets and how, Clarke said during Monday’s address that another type of interference favored by the agency — influencing and intentionally degrading encryption standards — need to be scraped.

Since June, those Snowden leaks have exposed an array of previously covert NSA operations, including programs that put the emails of foreign leaders and phone data pertaining to millions of Americans into the hands of the US government. According to Clarke, though, the NSA’s handling of encryption standards — as exposed by Snowden — has serious repercussions.

In September, leaked documents courtesy of Mr. Snowden showed the NSA has invested millions of dollars to be able to decrypt “large amounts” of supposedly secure data, an operation that spies at Britain’s GCHQ called “an aggressive, multipronged effort to break widely used Internet encryption technologies.” Then in December, further Snowden documents showed that RSA, a private company considered a staple of the computer security industry, had secretly entered into a $10 million contract with the NSA to create a government-friendly “backdoor” in its products.

Because of the NSA’s efforts, Clarke said during Monday’s event, “the trust in encryption has been greatly eroded.”

“The encryption standards need to be trusted,” he said, according to Infosecurity Magazine. “The US government has to get out of the business of fucking around with encryption standards.”

“We need to rebuild the trust in encryption; we need to have the US government forced some way into ensuring this happens,” he said.

When Clarke and four other Obama-appointed experts weighed in on the NSA’s programs for the report released in December, the group said they were “unaware of any vulnerability created by the US government in generally available commercial software that puts users at risk of criminal hackers or foreign governments decrypting their data. Moreover, it appears that in the vast majority of generally used, commercially available encryption software, there is no vulnerability, or ‘backdoor,’ that makes it possible for the US government or anyone else to achieve unauthorized access.”

As part of the group’s recommendations, they advised that the NSA “not engineer vulnerabilities into the encryption algorithms that guard global commerce” and “not demand changes in any product by any vendor for the purpose of undermining the security or integrity of the product, or to ease NSA’s clandestine collection of information by users of the product.”

http://rt.com/usa/clarke-summit-encryption-standards-711/

Labels:

Big Brother,

GIB,

Libertarianism,

life,

technology

Wednesday, February 26, 2014

Gold price rigging fears put investors on alert

February 23, 2014 8:19 am

By Madison Marriage

Global gold prices may have been manipulated on 50 per cent of occasions between January 2010 and December 2013, according to analysis by Fideres, a consultancy.

The findings come amid aprobe by German and UK regulatorsinto alleged manipulation of the gold price, which is set twice a day byDeutsche Bank,HSBC, Barclays,Bank of Nova ScotiaandSociété Généralein a process known as the “London gold fixing”.

Fideres’ research found the gold price frequently climbs (or falls) once a twice-daily conference call between the five banks begins, peaks (or troughs) almost exactly as the call ends and then experiences a sharp reversal, a pattern it alleged may be evidence of “collusive behaviour”.

“[This] is indicative of panel banks pushing the gold price upwards on the basis of a strategy that was likely predetermined before the start of the call in order to benefit their existing positions or pending orders,” Fideres concluded.

“The behaviour of the gold price is very suspicious in 50 per cent of cases. This is not something you would expect to see if you take into account normal market factors,“ said Alberto Thomas, a partner at Fideres.

Alasdair Macleod, head of research at GoldMoney, a dealer in physical gold, added: “When the banks fix the price, the advantage they have is that they know what orders they have in the pocket. There is a possibility that they are gaming the system.”

Pension funds, hedge funds, commodity trading advisers and futures traders are most likely to have suffered losses as a result, according to Mr Thomas, who said that many of these groups were “definitely ready” to file lawsuits.

Daniel Brockett, a partner at law firm Quinn Emanuel, also said he had spoken to several investors concerned about potential losses.

“It is fair to say that economic work suggests there are certain days when [the five banks] are not only tipping their clients off, but also colluding with one another,” he said.

Matt Johnson, head of distribution at ETF Securities, one of the largest providers of exchange traded products, said that if gold price collusion is proven, “investors in products with an expiry price based around the fixing could have been badly impacted”.

Gregory Asciolla, a partner at Labaton Sucharow, a US law firm, added: “There are certainly good reasons for investors to be concerned. They are paying close attention to this and if the investigations go somewhere, it would not surprise me if there were lawsuits filed around the world.”

All five banks declined to comment on the findings, which come amid growing regulatory scrutiny of gold and precious metal benchmarks.

BaFin, the German regulator, has launched an investigation into gold-price manipulation and demanded documents from Deutsche Bank. The bank last month decided toend its role in gold and silver pricing. The UK’s Financial Conduct Authority is also examining how the price of gold and other precious metals is set as part of a wider probe into benchmark manipulation following findings of wrongdoing with respect toLiborand similarallegations with respect to the foreign exchange market.

The US Commodity Futures Trading Commission has reportedly held private meetings to discuss gold manipulation, but declined to confirm or deny that an investigation was ongoing.

Tuesday, February 25, 2014

Vayer says he would like to believe Froome, but doesn’t have enough information

- By Andrew Hood

Just when it seemed like things had gone quiet, former Festina trainer Antoine Vayer lit up Twitter last weekend with pointed comments about Chris Froome’s recent performance en route to winning the Tour of Oman.

Froome's power output ~6.70 W/kg at Oman Tour, 9 mn for "GREEN mountain's" It's a fucking RED ridiculous performance. Bullshit, joke.

— Antoine VAYER (@festinaboy) February 22, 2014

It was trademark Vayer, who shoots from the hip and thrives on a being a thorn in the side of cycling’s establishment. He had no way of proving those were indeed Froome’s accurate power numbers, but it didn’t matter.

Last summer, Vayer wrote the provocative study called “Not Normal,” in which he broke down 21 top performances over the past 30 years, comparing and ranking power numbers based on a credibility scale.

Vayer’s comments, coupled with others, helped push the power numbers debate to the center of the conversation during last year’s Tour de France.

Some say he’s crackpot at best, vindictive and ill informed at worse. Regardless of what his detractors say, he remains one of the strongest voices of skepticism within cycling.

While others have bought into the notion that cycling has indeed changed, Vayer remains incredulous that the marginal gains of “new cycling” could equate to the superlative performances of the EPO era.

VeloNews caught up with Vayer as the peloton rolls into the 2014 season to gauge his mood. He’s still skeptical, but admitted he sees a glimmer of hope.

VeloNews: There is talk of a lot of changes within the sport, but you remain skeptical. Coming into 2014, how do you view the peloton?

Antoine Vayer: There are two things: doping and true sport. Today, there are more and more clean riders. I was recently at some races in the south of France, and I have close contact with many riders, and they came to me to say you can stay pure and still have good results. Many riders are fed up with the doping culture. It does not concern them. Today, the professionals train better and more, and they can begin the season with very good results. Without a doubt, there are more good pure riders at the top level. I remember back in the 1990s, nobody really trained. Everyone was quite stupid. There was no science, no coaching, no training camps, no warmups before a time trial. Now everyone is doing that. The level has increased.

Antoine Vayer: There are two things: doping and true sport. Today, there are more and more clean riders. I was recently at some races in the south of France, and I have close contact with many riders, and they came to me to say you can stay pure and still have good results. Many riders are fed up with the doping culture. It does not concern them. Today, the professionals train better and more, and they can begin the season with very good results. Without a doubt, there are more good pure riders at the top level. I remember back in the 1990s, nobody really trained. Everyone was quite stupid. There was no science, no coaching, no training camps, no warmups before a time trial. Now everyone is doing that. The level has increased.

VN: Fair enough, but you’re obviously not convinced.

AV: The problem still is at the very high level of the sport, according to me, there are still cheaters and liars. The goal is to reduce the difference between the good, pure riders and the cheaters. We are close, but not yet there.

AV: The problem still is at the very high level of the sport, according to me, there are still cheaters and liars. The goal is to reduce the difference between the good, pure riders and the cheaters. We are close, but not yet there.

VN: We’re already seeing a lot of top riders with some strong early-season performances. What do you take from that?

AV: Normally, when you look at a season, say from February to the Tour, a top rider can improve by 5-15 percent. This year some are starting at incredibly high levels. [Alejandro] Valverde, [Chris] Froome, and some others, they are very good. They could race the Tour de France right now. If they increase even more, it will be fantastic. They will really be flying. Before, people would train with a peak of form; today they are already at a high level. That makes you think a lot.

AV: Normally, when you look at a season, say from February to the Tour, a top rider can improve by 5-15 percent. This year some are starting at incredibly high levels. [Alejandro] Valverde, [Chris] Froome, and some others, they are very good. They could race the Tour de France right now. If they increase even more, it will be fantastic. They will really be flying. Before, people would train with a peak of form; today they are already at a high level. That makes you think a lot.

VN: Some argue that training methods of have changed, that riders can build good form early and hold it, such as Bradley Wiggins and Chris Froome, who raced and won from February to July.

AV: They win everything! They have no peak form. Froome has the same form in Oman now as he did at the end of last year’s Tour. I cannot imagine he will be in better shape in July. If he is [laughs], all the riders should not even bother to show up.

AV: They win everything! They have no peak form. Froome has the same form in Oman now as he did at the end of last year’s Tour. I cannot imagine he will be in better shape in July. If he is [laughs], all the riders should not even bother to show up.

VN: You posted a Twitter message this week that cast doubt on Froome. Do you not believe his power numbers are credible?

AV: Chris is one of the reasons why I have many doubts. We can begin to hope to believe, but with Chris, there is too much doubt. As long as we do not have proof that he is OK, that he is not cheating, I will have too much doubt.

AV: Chris is one of the reasons why I have many doubts. We can begin to hope to believe, but with Chris, there is too much doubt. As long as we do not have proof that he is OK, that he is not cheating, I will have too much doubt.

VN: Sky and Froome have been quite open, but that’s not enough for you?

AV: I would like to be convinced that Froome is exceptional. For me, what he does is unbelievable. He has not given proof, except saying that, “I train well, blah, blah, blah.” That is not enough.

AV: I would like to be convinced that Froome is exceptional. For me, what he does is unbelievable. He has not given proof, except saying that, “I train well, blah, blah, blah.” That is not enough.

VN: What would convince you? Have you ever tried to get more evidence directly from Sky to convince you?

AV: As a matter of fact, I met with Dave Brailsford and Tim Kerrison [Sky's general manager and top coach] after the time trial in Saint Malo last year, when Froome was second. I was very surprised that they met with me. We spoke for nearly two hours that evening after the race. All they did was speak, and for them to say to me that he was exceptional was not enough. I said, “I have nothing against you, but can you give me physical evidence?” They said, “No, we are the best, we train the best,” and that was it. For me, it was not enough.

AV: As a matter of fact, I met with Dave Brailsford and Tim Kerrison [Sky's general manager and top coach] after the time trial in Saint Malo last year, when Froome was second. I was very surprised that they met with me. We spoke for nearly two hours that evening after the race. All they did was speak, and for them to say to me that he was exceptional was not enough. I said, “I have nothing against you, but can you give me physical evidence?” They said, “No, we are the best, we train the best,” and that was it. For me, it was not enough.

VN: Did you ask to see Froome’s power numbers or other data that might have convinced you?

AV: They showed me nothing. No official power numbers, nothing. One thing that struck me; I remember when I was at the Tour in 2000, and in the hotel of the yellow jersey, there were 500 people milling around the hotel, watching the mechanics, waiting to see the riders. That night with Team Sky, there was no public. No one. Not one single fan. For me, that was quite a shock. It’s a new phenomenon in cycling. We have races, but there is no public. Like races in China, Dubai, even in Europe, there is no public at all.

AV: They showed me nothing. No official power numbers, nothing. One thing that struck me; I remember when I was at the Tour in 2000, and in the hotel of the yellow jersey, there were 500 people milling around the hotel, watching the mechanics, waiting to see the riders. That night with Team Sky, there was no public. No one. Not one single fan. For me, that was quite a shock. It’s a new phenomenon in cycling. We have races, but there is no public. Like races in China, Dubai, even in Europe, there is no public at all.

VN: To defend Froome, Sky insists that their power numbers are private, but they have revealed other information. What would be enough to satisfy your doubts?

AV: Well, to speak of data, things like the biological passport is not enough. They should add other tests to measure the physical ability of a rider, like VO2 max, a Cybex test, there are plenty of ways to measure someone’s capability, to know if they are OK. But no one wants to share that information.

AV: Well, to speak of data, things like the biological passport is not enough. They should add other tests to measure the physical ability of a rider, like VO2 max, a Cybex test, there are plenty of ways to measure someone’s capability, to know if they are OK. But no one wants to share that information.

VN: You speak about how more clean riders can post results. In your view, what percentage of the peloton is clean? Back in the 1990s, we now know that just about everyone was doping. What’s your view of today’s peloton?

AV: Those who want to race clean can do it and post results. Riders like Dan Martin winning Liège-Bastogne-Liège is a very good sign. He is a rider we can believe. That’s very encouraging. Back in 1998, there was one: [Christophe] Bassons. Today there are many Bassons. A clean rider is no longer the exception. There is talk of a change of culture, yet some people I speak to inside the peloton will tell me there are still some people who are “full gas.” What percentage is that? It’s hard to say. It’s better now for clean riders, but still many riders are “full gas.” What is sure is that if Bassons raced today, he would now have many good results.

AV: Those who want to race clean can do it and post results. Riders like Dan Martin winning Liège-Bastogne-Liège is a very good sign. He is a rider we can believe. That’s very encouraging. Back in 1998, there was one: [Christophe] Bassons. Today there are many Bassons. A clean rider is no longer the exception. There is talk of a change of culture, yet some people I speak to inside the peloton will tell me there are still some people who are “full gas.” What percentage is that? It’s hard to say. It’s better now for clean riders, but still many riders are “full gas.” What is sure is that if Bassons raced today, he would now have many good results.

VN: You’re basing that assumption on how you’re interpreting the power numbers of the top riders?

AV: At the top of the sport, there are still some cheaters and dopers, without a doubt. Measuring their performances is a good way to see that. What was interesting is that during last year’s Tour, I met many people who are doing the same work as me. We all make calculations, and we all agree that the top performances are not normal. There is not one of them who say that it’s possible. There are still too many riders that are not normal.

AV: At the top of the sport, there are still some cheaters and dopers, without a doubt. Measuring their performances is a good way to see that. What was interesting is that during last year’s Tour, I met many people who are doing the same work as me. We all make calculations, and we all agree that the top performances are not normal. There is not one of them who say that it’s possible. There are still too many riders that are not normal.

VN: Some have suggested that your power calculations are off, that they are founded on incomplete information, or that they are overly simplistic. How do you respond to that?

AAV: They are accurate. There are many people making these calculations across the world, and we all come to a similar conclusion. I also have friends within the peloton, riders who have reached out to me, and who help me with my calculations. For example, to calculate Froome’s numbers in Oman, a rider who finished very close to him gave us his power meter files. So that way, we can make direct and indirect calculations.

AAV: They are accurate. There are many people making these calculations across the world, and we all come to a similar conclusion. I also have friends within the peloton, riders who have reached out to me, and who help me with my calculations. For example, to calculate Froome’s numbers in Oman, a rider who finished very close to him gave us his power meter files. So that way, we can make direct and indirect calculations.

VN: But there must be some margin of error?

AV: They are very accurate. They can be off by one percent. People who say that our numbers are off do not understand what we are doing, or they say it to make us lose credibility. The calculations are accurate. Believe me, I would love to see a Tour raced at 10 watts less. That would be a fantastic Tour!

AV: They are very accurate. They can be off by one percent. People who say that our numbers are off do not understand what we are doing, or they say it to make us lose credibility. The calculations are accurate. Believe me, I would love to see a Tour raced at 10 watts less. That would be a fantastic Tour!

VN: Young riders coming into the sport, such as Andrew Talansky and Taylor Phinney, have suggested they have never been approached about doping, and say that no one has ever encouraged them to dope. What do you take from those kinds of comments?

AV: I don’t know them personally, but what they are saying is quite different from what the dopers and cheaters used to say. They have nothing to hide, and you can sense that. I feel good about what they say and how they race. If Phinney were clean, even if he is in top form and at a peak, would he ever be able to ride at the front of the Tour? No! He would have to be like [Miguel] Indurain. I don’t think a rider as big as Phinney can ever win the Tour, unless he did the things Indurain did.

AV: I don’t know them personally, but what they are saying is quite different from what the dopers and cheaters used to say. They have nothing to hide, and you can sense that. I feel good about what they say and how they race. If Phinney were clean, even if he is in top form and at a peak, would he ever be able to ride at the front of the Tour? No! He would have to be like [Miguel] Indurain. I don’t think a rider as big as Phinney can ever win the Tour, unless he did the things Indurain did.

VN: What kind of contacts do you have in the peloton today?

AV: The best experts on doping are the riders and former riders who are now sport directors. They were part of this culture of lying and cheating. They are the experts. They can look at a rider and they can tell immediately if something is not right, by their pedaling style, how they’re breathing. What is good now is that the cycling public is now very well informed. People are not as gullible as before. Today, if a rider like Phinney pushed 450 watts for 40 minutes up a climb like La Plagne after five hours of racing, they would scream, “who is this guy?” The public doesn’t have to listen to the journalists anymore. They can make up their own minds, and say this is bullshit. And I would like to explain performances like Froome’s, but I cannot explain it. They must give me more evidence before I can believe them.

AV: The best experts on doping are the riders and former riders who are now sport directors. They were part of this culture of lying and cheating. They are the experts. They can look at a rider and they can tell immediately if something is not right, by their pedaling style, how they’re breathing. What is good now is that the cycling public is now very well informed. People are not as gullible as before. Today, if a rider like Phinney pushed 450 watts for 40 minutes up a climb like La Plagne after five hours of racing, they would scream, “who is this guy?” The public doesn’t have to listen to the journalists anymore. They can make up their own minds, and say this is bullshit. And I would like to explain performances like Froome’s, but I cannot explain it. They must give me more evidence before I can believe them.

VN: Changing topic, what is your view of the efforts by the UCI to investigate doping within the sport?

AV: When we met in 2012, we called for a “truth and reconciliation” within the sport. This effort [CIRC] is not truth and reconciliation. I don’t think it’s enough. Maybe going further would be a Pandora’s box. We will see. I want to help. I believe we should help [UCI president Brian] Cookson because he has the will to change things. We still need more pressure on riders and managers to change.

AV: When we met in 2012, we called for a “truth and reconciliation” within the sport. This effort [CIRC] is not truth and reconciliation. I don’t think it’s enough. Maybe going further would be a Pandora’s box. We will see. I want to help. I believe we should help [UCI president Brian] Cookson because he has the will to change things. We still need more pressure on riders and managers to change.

VN: Many are hopeful Lance Armstrong will step forward, do you expect his cooperation?

AV: I think Armstrong would say many things to the right person. What he lacks is confidence in the process. Armstrong, like all the dopers and cheaters, needs to be involved in the process. They are the experts. Imagine if Armstrong put the same energy and focus into cleaning up cycling as he did into winning the Tour while doping? That would be something! Doping is the problem that must be solved in cycling. It can be solved quite quickly if we have the will. The problem is always money.

AV: I think Armstrong would say many things to the right person. What he lacks is confidence in the process. Armstrong, like all the dopers and cheaters, needs to be involved in the process. They are the experts. Imagine if Armstrong put the same energy and focus into cleaning up cycling as he did into winning the Tour while doping? That would be something! Doping is the problem that must be solved in cycling. It can be solved quite quickly if we have the will. The problem is always money.

VN: From listening to you, it sounds like you remain skeptical, but you also see reason for encouragement. Is that accurate?

AV: I see a lot of reasons to be optimistic. If everyone has the same will to fight doping, it could end very fast. All the people who do not want to admit that, they must be out of the sport. And all the journalists who say that cycling was still beautiful even when the peloton was doped, they must be out as well. The sport has come a long way in 20 years. Some riders appreciate me, but to some people, I am still the devil.

AV: I see a lot of reasons to be optimistic. If everyone has the same will to fight doping, it could end very fast. All the people who do not want to admit that, they must be out of the sport. And all the journalists who say that cycling was still beautiful even when the peloton was doped, they must be out as well. The sport has come a long way in 20 years. Some riders appreciate me, but to some people, I am still the devil.

VN: Is there a perception gap, between the headlines from the EPO era and today’s peloton, even if you remain skeptical?

AV: There is. Last year, I wrote this magazine called “Not Normal,” and someday I would like to write another magazine, with 21 reasons to believe in the Tour. I would like to write something like that, to convince the public they can follow the sport, they can believe the performances, that their kids should race their bikes, that riders can compete at a high level. I would like to say Froome is clean. Believe me, I would like to write poetry about the beauty of cycling rather than write about power numbers! But I am still waiting for that moment.

Labels:

cycling,

Fraud,

GIB,

science,

technology

Monday, February 24, 2014

Another Banker Dies

Which brings the total number of recent banker deaths to 9 (via Intellihub):

1 – William Broeksmit, 58-year-old former senior executive at Deutsche Bank AG, was found dead in his home after an apparent suicide in South Kensington in central London, on January 26th.

2- Karl Slym, 51 year old Tata Motors managing director Karl Slym, was found dead on the fourth floor of the Shangri-La hotel in Bangkok on January 27th.

3 – Gabriel Magee, a 39-year-old JP Morgan employee, died after falling from the roof of the JP Morgan European headquarters in London on January 27th.

4 – Mike Dueker, 50-year-old chief economist of a US investment bank was found dead close to the Tacoma Narrows Bridge in Washington State.

5 – Richard Talley, the 57 year old founder of American Title Services in Centennial, Colorado, was found dead earlier this month after apparently shooting himself with a nail gun.

6 -Tim Dickenson, a U.K.-based communications director at Swiss Re AG, also died last month, however the circumstances surrounding his death are still unknown.

7 – Ryan Henry Crane, a 37 year old executive at JP Morgan died in an alleged suicide just a few weeks ago. No details have been released about his death aside from this small obituary announcement at the Stamford Daily Voice.

8 - Li Junjie, 33-year-old banker in Hong Kong jumped from the JP Morgan HQ in Hong Kong this week.

http://www.zerohedge.com/news/2014-02-24/another-successful-banker-found-dead

Sunday, February 23, 2014

HFT - The Wall Street Code

The Wall Street Code (Marije Meerman, VPRO)

Wednesday, February 19, 2014

Epoch Times Interview with @JamesGRickards

Epoch Times: Mr. Rickards, in our last interview (Part 1, Part 2), we talked about gold and why it should rally. You also said the Chinese are behind buying a lot of physical …

James Rickards: I met with the largest gold refinery in the world, the head of precious metals operations. He’s recently expanded his own capacity; they put a whole new area in their factory and it’s highly automated. And he’s working triple shifts, he is working 24 hours a day to produce gold.

James Rickards: I met with the largest gold refinery in the world, the head of precious metals operations. He’s recently expanded his own capacity; they put a whole new area in their factory and it’s highly automated. And he’s working triple shifts, he is working 24 hours a day to produce gold.

He is producing 20 tons a week and half of that is going to China. So that’s 10 tons a week, which is about 500 tons a year. And that’s just one refinery, not counting all the others, that’s a lot of gold.

He said the Chinese want more, but he won’t supply it because he has regular customers. He supplies Rolex watches and other high net-worth individuals and institutions; these are all long standing customers. He can’t refuse to fill their orders.

He said: “I’m making all the gold I can, working 24 hours a day, sending as much gold as I possibly can to China, 500 tons a year and the Chinese still want more.”

Epoch Times: How can supply keep up?

Mr. Rickards: So where is the gold coming from? It’s coming from mining output, scrap, and 400 ounce bars. The Chinese are basically turning their back on the London gold market and creating a new standard. So the old standard was the 99 percent pure gold 400 ounce bar, the new standard is a 99.99 percent pure gold one kilogram bar.

Mr. Rickards: So where is the gold coming from? It’s coming from mining output, scrap, and 400 ounce bars. The Chinese are basically turning their back on the London gold market and creating a new standard. So the old standard was the 99 percent pure gold 400 ounce bar, the new standard is a 99.99 percent pure gold one kilogram bar.

So what the refineries are doing is they are taking 99 percent 400 ounce bars, and they are refining them to 99.99 percent kilo bars because that’s the only thing China wants.

You are taking 400 ounce bars, which weigh about 25 pounds or 10 kilos, and turning them into one kilo. Chinese like one kilo because there is a lot of consumer demand for that, and it’s a lot better for smuggling. There is a lot of capital flight coming out of China.

The Shanghai Gold Exchange is in the process of replacing London as the center of gold trading in the world, and I have already mentioned a couple of aspects of that [in my earlier interviews].

One is a lot of floating supply is moving there; two the Chinese have changed the standard from 400 ounce bars to one kilo bars, and they are facilitating the trading and building of very large vaults in Shanghai and they’ve got their own refineries. So taking all these trends together, it’s very clear that the center of gold trading is moving from London to Shanghai.

Epoch Times: What about the Chinese purchase of the JPMorgan gold vault in New York?

Mr. Rickards: I don’t put much stock in buying the JPMorgan vault, that was a real estate transaction. They’ve bought the whole Chase Manhattan skyscraper. There happens to be a vault in the basement. I can’t imagine they spend upward of a billion dollars on a building so they can get a vault. I am sure it was a real estate deal, and they wanted the building, but yeah, there is a vault.

Mr. Rickards: I don’t put much stock in buying the JPMorgan vault, that was a real estate transaction. They’ve bought the whole Chase Manhattan skyscraper. There happens to be a vault in the basement. I can’t imagine they spend upward of a billion dollars on a building so they can get a vault. I am sure it was a real estate deal, and they wanted the building, but yeah, there is a vault.

Also, if you are Chinese, why would you want your gold in New York, you would want your gold in Shanghai. But what is going on in Shanghai is very significant. Suffice to say that China is the coming world gold power. In terms of the world monetary system, Shanghai is becoming the center of world gold trading as opposed to London and putting these two things together, you have to ask yourself why?

Epoch Times: Why?

Mr. Rickards: I think they see something most people don’t. The international monetary system based on paper currencies is fragile and likely to collapse, and when the system needs to be reformed, the people with the largest voice at the table will be the people with the most gold.

Mr. Rickards: I think they see something most people don’t. The international monetary system based on paper currencies is fragile and likely to collapse, and when the system needs to be reformed, the people with the largest voice at the table will be the people with the most gold.

Epoch Times: Right, but even including this frantic buying, the Chinese have a lower percentage of their money supply reserved in gold than the United States.

Mr. Rickards: I agree with that, which tells me they will keep buying. I think they have acquired three or four thousand tons secretly, but I don’t think they are done.

Mr. Rickards: I agree with that, which tells me they will keep buying. I think they have acquired three or four thousand tons secretly, but I don’t think they are done.

Epoch Times: Can China supply the world with a reserve currency?

Mr. Rickards: Not with the yuan. A: They don’t want to open their capital account. B: The yuan can’t possibly be a global reserve currency. It is expanding in use as a trade currency, but most people don’t understand the difference between a trade currency and a reserve currency. The trade currency is just a way of keeping score in the balance of payments mechanism.

Mr. Rickards: Not with the yuan. A: They don’t want to open their capital account. B: The yuan can’t possibly be a global reserve currency. It is expanding in use as a trade currency, but most people don’t understand the difference between a trade currency and a reserve currency. The trade currency is just a way of keeping score in the balance of payments mechanism.

If you are Brazil and China, and Brazil agrees to take yuan for Brazilian goods, and China agrees to take reals in exchange for Chinese goods, that’s fine. Then you just keep score and settle up every now and then. That’s a trade currency.

But to be a reserve currency means that countries that have reserves have to invest it in something, so you need a deep liquid pool of investable assets. China does not have that. There is no Chinese bond market. There are a few Dim-Sum bonds and a few other things, but there is no Chinese government bond market to speak of, and it would take 10 to 15 years to develop one.

But it’s not just about issuing debt. China doesn’t have to borrow because they have too many reserves. If they don’t borrow then there are no bonds, and if there are no bonds there can’t be a reserve currency because there is nothing to invest in.

Even if they did, there is no rule of law in China, so why would you trust the Chinese not to steal your money? So putting all that together, they are not even close to being a reserve currency.

Epoch Times: So what are the Chinese up to?

Mr. Rickards: What China wants is the SDR [Special Drawing Right, a type of money for governments], because it’s not the dollar. It’s issued by the IMF [International Monetary Fund], and China is simultaneously lobbying for more votes in the IMF.

Mr. Rickards: What China wants is the SDR [Special Drawing Right, a type of money for governments], because it’s not the dollar. It’s issued by the IMF [International Monetary Fund], and China is simultaneously lobbying for more votes in the IMF.

China is trying to use its willingness to lend money to the IMF to purchase SDR notes from the IMF to give the IMF money to bail out Europe. It’s trying to use that as a lever to get more votes. If it has more votes, it would be comfortable using the SDR as a reserve currency, because its use would be regulated by the membership and that would make China the second largest member after the United States.

The United States is opposing it, but Christine Lagarde [Head of the IMF], is pushing very hard to increase the Chinese role. It’s a complicated global game.

If you said to me, does China want to get rid of the dollar as the global reserve currency, the answer is yes. But most people think it’s that they want the yuan. They don’t. It’s the SDR.

Epoch Times: What can the United States do about the money owed to China?

Mr. Rickards: All we have to do is inflate our currency and pay them back in cheaper dollars and that reflects a wealth transfer from China to the United States. So China is completely vulnerable to that, which is why they are buying gold to create a hedge.

Mr. Rickards: All we have to do is inflate our currency and pay them back in cheaper dollars and that reflects a wealth transfer from China to the United States. So China is completely vulnerable to that, which is why they are buying gold to create a hedge.

If we inflate, then gold will go up. So what they lose on the paper, they make on the gold.

Labels:

Central Banks,

Currency Wars,

Gold,

Inflation

Monday, February 17, 2014

Sunday, February 16, 2014

Friday, February 14, 2014

Thursday, February 13, 2014

Armstrong: If I was the carpenter, Pantani was the artist

American remembers great rivalry

I'll never forget when I heard about Marco's passing. I was at home in Girona when a message came through. Complete shock is the only way I can sum up how I felt.

Ironically, and I remember it like it was yesterday, earlier that day I was having a conversation with Michele Ferrari. He and Marco didn't work together, but the two of them were friendly and I asked him, 'hey what's going on with Marco these days?' Everything had seemed to slow, and there wasn't much news. Michele told me he hadn't heard good reports lately and he was concerned how things might end up.

That night, I received a message from Italian journalist Pier Bergonzi that read "Pantani is dead". I sat there alone, and thought "Fuck!". The climber I'd battled on, and off, the bike for so long was dead.

It's nearly ten years since his passing but I still remember my very first race with him. It was at the Tour of Mexico, in 1994. I was there with Motorola and Carerra were there with Chiapucci and Pantani too. I have to be honest I didn't notice him much at the race. He wasn't a team leader and, although he was seen as a promising climber, he'd not made a huge impact on my life yet.

Of course, I took notice when he was second at the Giro later that year. That's when the whole world sat up and took notice. There was this whole plot between Evgeni Berzin and Miguel Indurain and in the middle of that was Pantani, who finished second and won back-to-back stages. He stole the show and he damn near stole the race as well. I wasn't a GC rider at the time, so I didn't give it a lot of thought and I wasn't fixated on the Giro, like I later would be with the Tour.

Marco had a lot of style as a bike racer. He was a complicated enigma, who had a lot of character, a ton (this is how yanks spell this word) of charisma and people were compelled by him and the way in which he flew up mountains.

On the bike he was a quiet guy though. There weren't these huge gestures or flamboyance, like you had with other Italians, because Marco was a rider who would do his talking when and where it matted. On the climbs, out of the saddle, and with the bunch busting a gut just to stay with him.

I remember how he used to be surrounded by his entire team in the peloton, almost to the point where it was annoying. We did some of that too, but his teammates were very protective of him and if you came anywhere near him you'd get the wrath of his entire squad. But style-wise he was smooth, efficient of course, and just so, so explosive. He had the ability to detonate a race and, as a rival, as another member of the peloton, you had to accept and respect his ability.

Forget the star aspect. Pantani wasn't a star, he was more like a rock star. He had the aura, he had the following and he was huge. As an American coming over and playing a European sport, I was in a different position. I was on the other side, not part of the ingrained culture and seen by some as the outsider. Pantani was right at home, he was on his turf and he was the main man. If I was the carpenter, then he was the artist. He had all the panache in the world, all the panache you could fit into a small climber, and I, if I'm honest, didn't have that.

We went up against each other in the Tour, in 2000, and while everyone remembers days like Ventoux, there was a bit of a back-story there too. In 1998, Pantani trounced the field. He'd beaten Jan [Ullrich]. However, in 1999 after I won, and going into 2000, I'm sure Marco, Jan, the press and the fans all thought that the '99 race wasn't well attended. The last two winners hadn't been there and maybe my win had been a fluke. Heck, even I had some doubts, some thoughts that '99 would be my only shot.

I didn't know what was going to happen in that race, but I still trained, I still prepared and I came to the start as ready as possible. We didn't have a specific plan for Marco. We knew his strengths and we certainly knew mine. We had to wait until the first climbs to see how everyone stacked up. So we waited, and waited, and then we reached Hautacam. I can't remember every detail but there was me, [Alex] Zulle, Pantani, and maybe a couple of others at the head of the race. I pulled, Marco pulled, we were all trading off, and then I went to the front. Johan [Bruyneel] came onto the radio and told me Marco had been dropped. Everyone knows the rest but Marco, with his spirit to fight, wasn't finished.

He had that anger inside him that meant he fought for everything. Maybe it was a bit of a Napoleon complex, but he was a real fighter.

Everyone knows that we didn't see eye-to-eye on a lot of things. We didn't say nice things to each other, especially in the press. If I'm honest, we didn't particularly like one another, but I always felt that the sport was a better place with Marco in it.

Perhaps, if we had met under different circumstances, we would have gotten along. If it wasn't for the language barrier, some of the rivalry and some of the negative things we said about one another, I think we could have been friends.

We had a reconciliation of sorts at one point. When we were feuding, it got to the point where things were becoming too much for me, for him and for everyone. We decided to sit down face to face, man to man. So one night in Murcia, in 2001, Marco, [La Gazzetta dello Sport's Pier] Bergonzi, and Gianpaolo Mondoni, who rode on his team and spoke English, sat down for tea. I don't know if Marco really wanted to be there that much, but it was pleasant enough. Unfortunately, despite our face-to-face, the relationship remained the same. This would be the last time we ever spoke face to face.

So much of that hostility came down to what happened on the Ventoux in 2000. I'm not here to glorify anything, everyone knows what happened that day, but we were at the head of the race and trading pulls. I told him, in my shitty Italian, 'you can have the win'. He thought I was saying 'you need to go faster'. My Italian was so bad though, I could have been saying anything, but we were going plenty fast enough, believe me. What happened that day didn't help things, and from there on things were never the same.

From my point of view, he said a few things about '99, saying it might have been a fluke, but having said that the list of people in that queue were a mile long. There were times, on my part, when I became too wrapped up in the rivalry, too wrapped up in the war of words.

If I could go back I would handle quite a few relationships differently and the one with Marco is no different. My fundamental mistake was that while it was fine to be competitive with your rivals on the bike, when you step off the bike we're all humans and we all deserve to be treated with respect. I never switched off and while that killer mentality worked on the bike, it didn't work well when you're having a coffee or having a press conference. That was my mistake.

I don't blame the doping in cycling for his death. I think he was an incredible personality, who was also flawed – like myself. To some extent the doping had made him who he was, but then again we could have all said that. The reality is that the fame and the speed at which he lived life was what killed him. He simply couldn't keep up with it.

Later on, when you get off the bike that's when you need to be careful. Fame is fleeting and life after being at the top is never the same. Pantani suffered greatly. He went from being a god in Italy to being someone who lost so much. People don't look at you the same, after something like that, and you've got to be prepared for the day when you're just a dude walking down the street and no longer the star. I think about that a lot, but he wasn't ready for that and he wasn't ready for what Italy showered him with – both before and after his problems. He was a god to them and it was that pace that ultimately undid him.

How fans should view Pantani nowadays is a complex question, but one that needs a certain level of context and understanding, before reflection. I think that if you watch those performances you should view them with great appreciation and great admiration. When you name all the other winners from those days, all the riders, he was geared up in just the same way and he still fucking won. That's going to frustrate some people to hear, but you have to remember that he came into a program and that was that. He wasn't going to change the system and everyone in that peloton that he beat played by the same rules.

Marco is no longer here and it's been a long and difficult ten years for cycling since. Marco's passing is cycling's loss both because of the memories he gave us and because he could have helped the sport too. I don't know what Marco would make of the state of cycling today. He was a strong character and someone with soul and it was a privilege to do battle with him.

http://www.cyclingnews.com/features/armstrong-if-i-was-the-carpenter-pantani-was-the-artist

Labels:

cycling

Wednesday, February 12, 2014

Ed Moy

Edmund C. Moy (born September 12, 1957) is an American businessman and former government official. From 2006 to 2011 he served as the 38th Director of the United States Mint.

Labels:

Gold

Thursday, February 6, 2014

Wednesday, February 5, 2014

Nanex ~ 31-Jan-2014 ~ Lobbyists, Lies, and HFT

While we welcome a frank debate into the problems of the U.S. stock market and the role of high frequency trading (HFT), it is crucial that participants are honest and willing to shine a spotlight on outright fraud or misrepresentation. We feel obligated to respond to this article, written by the HFT lobbyist group Modern Markets Initiative (MMI). In the article, MMI attempts to discredit the Wall Street Journal's A Suspect Emerges in Stock-Trade Hiccups: Regulation NMS, and seizes the opportunity to "revisit some commonly held misconceptions about electronic markets and high frequency trading (HFT)". We'll seize the opportunity to point out some intellectual dishonesty.

MMI writes:

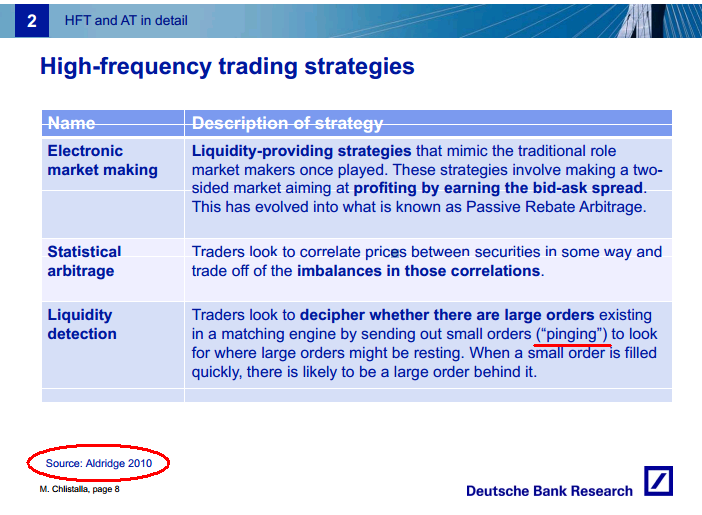

Is MMI is unaware of basic information gathering techniques, or that the industry already has a term for this strategy? It's called "pinging". Put simply, the absence of a response is valuable information. Take a look at this slide from Deutsche Bank Research describing "High frequency trading strategies".

The same Irene Aldridge whose book is prominently linked on the front page of MMI as a trusted source of information about HFT.

In other words, MMI's hand-picked, trusted source, just destroyed any credibility MMI may have had.

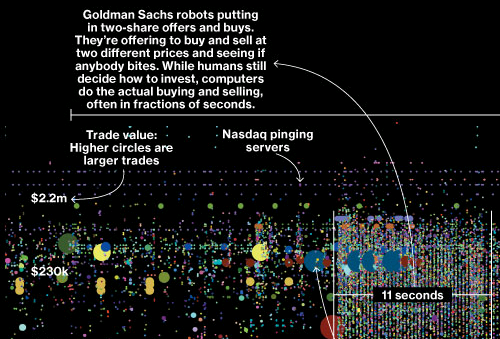

But just in case you don't have the same level of respect for Aldridge as MMI, it's easy to find other sources that talk about this strategy, such as this graphic from Business Week:

It helps to remember that MMI is a lobbyist organisation. They are paid to change people's minds: which is fine if it is accomplished with facts. Unfortunately, MMI presents very few, if any, real facts.

Nanex Research

Inquiries: pr@nanex.net

MMI writes:

First, an inaccuracy in the article. Mr. Bunge writes:

“Computerized firms called high-frequency traders try to pick up clues about what the big players are doing through techniques such as repeatedly placing and instantly canceling thousands of stock orders to detect demand. If such a firm’s algorithm detects that a mutual fund is loading up on a certain stock, the firm’s computers may decide the stock is worth more and can rush to buy it first.”One is hard pressed to figure out how “placing and instantly canceling” orders garners any information about someone else’s intent. The only concrete information you gain is that your own orders were not filled. Even if one accepted this vague claim at face value, to associate all high frequency trading with this activity is a gross mischaracterization that ignores the diversity of strategies and many benefits HFT brings to the markets.

Is MMI is unaware of basic information gathering techniques, or that the industry already has a term for this strategy? It's called "pinging". Put simply, the absence of a response is valuable information. Take a look at this slide from Deutsche Bank Research describing "High frequency trading strategies".

The slide gives attribution for this information to Aldridge 2010 (circled in red): that's the well known HFT proponent Irene Aldridge.

The same Irene Aldridge whose book is prominently linked on the front page of MMI as a trusted source of information about HFT.

In other words, MMI's hand-picked, trusted source, just destroyed any credibility MMI may have had.

But just in case you don't have the same level of respect for Aldridge as MMI, it's easy to find other sources that talk about this strategy, such as this graphic from Business Week:

It helps to remember that MMI is a lobbyist organisation. They are paid to change people's minds: which is fine if it is accomplished with facts. Unfortunately, MMI presents very few, if any, real facts.

Nanex Research

Inquiries: pr@nanex.net

Tuesday, February 4, 2014

Nanex ~ 01-Feb-2014 ~ What did the SEC know, and when did they know it?

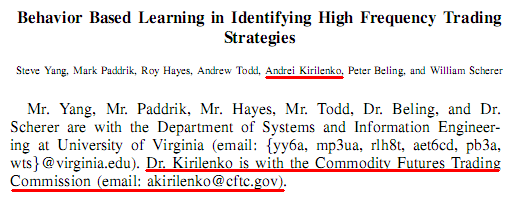

This academic paper was published on November 7, 2011: The paper was co-authored by Andrei Kirilenko, who at that time was the Chief Economist at the CFTC. The paper establishes that there exists empirical evidence of High Frequency Trading (HFT) manipulation; specifically, a strategy known as Spoofing or "Hype and Dump": The paper affirms that spoofing is illegal and that the practice is frequently discovered in both stocks and futures: Stock markets are regulated by the SEC, and futures by the CFTC. Since Dr. Kirilenko was a primary author of the final SEC Flash Crash Report, and because of his role as the Chief Economist for the CFTC, we know he had regular high level discussions with the SEC. The paper, dated November 7, 2011, states it cannot disclose specifics due to an ongoing CFTC investigation. We firmly believe that investigation concluded with the fine against Panther Energy Trading for spoofing the oil futures markets. We discuss this case in this document which includes dozens of charts - many that show the 600 millisecond order cancellation rate discussed in the paper. We have since documented other events that closely resemble the Panther case, as well as thousands of other instances of questionable HFT trading practices. Let's review the time-line:

It took the CFTC a full 21 months to bring action against an HFT firm for manipulating oil futures. Maybe that is the normal pace for government action, but right now, it is the least of our concern. There is something far more egregious exposed by this academic paper than the glacial pace of enforcement action. It is painfully obviously that a thread of corruption has woven itself tightly into places outside the reach of the normal checks and balances that make our nation so great. This needs the immediate attention of anyone concerned about our financial markets, and most importantly, those that have the power to do something about it. Please read on. We can now answer the questions: What did the SEC know, and when did they know it?The paper clearly establishes that regulators (SEC and CFTC) were aware of illegal HFT manipulation strategies involving fast order cancellation rates. They knew this in November 2011, and probably many months earlier, considering the time it takes for an academic paper to get published. If we juxtapose this knowledge with recent statements made by regulators regarding HFT, manipulation and high order cancellation rates, we see denial, uncertainty and doubt. We have even witnessed the regulator being told to shut down an academic program which was investigating other HFT manipulation strategies. That program was headed by none other than Dr. Andrei Kirilenko. What we don't see are actions or policy changes, or even discussions about reigning in HFT manipulation. This lack of regulator attention shows up in the market: the evidence of the same behavior continues to pile up, to the point that HFT manipulators believe they are untouchable.Just this week we refuted a claim made by a recently formed HFT lobbyist group who stated that there was no value to rapidly placing and cancelling orders and therefore HFT wouldn't do that. The week before, the CEO of an exchange expressed no concern about flickering quotes, which are a manifestation of HFT rapidly placing and cancelling orders. Things are only going to get worse until a major market event suddenly jolts leaders into action. Or those with influence start the process of restoring the system of checks and balances that made our country great. We hope it is the latter, but given the level and depth of corruption we have witnessed, the outlook is grim. |

Nanex Research

Inquiries: pr@nanex.net

Subscribe to:

Posts (Atom)