Saturday, June 30, 2012

Friday, June 29, 2012

Kelly Slater

Kelly Slater, 11-time ASP World Champion, surfs around the globe.

http://nyti.ms/KMsQ1h

http://nyti.ms/KMsQ1h

Labels:

art and architecture,

life,

music,

Waves

Thursday, June 28, 2012

Graham Wilson's Thoughts on the 2012 Tour de France

GRAHAM'S VIEW

June 27, 2012

Many weeks ago, before the Giro d’Italia ended, and well before races like the Dauphiné and Tour de Suisse could give an accurate guide as to who might win or challenge to win the Tour de France, an Australian client asked me to name my top-five favourites for the great race. I put Bradley Wiggins down to win, from Cadel Evans, Levi Leipheimer, Robert Gesink and Andy Schleck. If that same question was asked of me today, the only changes I’d make to that top-five is to switch Leipheimer with Gesink and remove the injured Schleck, putting Sammy Sanchez or Ryder Hesjedal in instead. The fact is, with so much time trialling on a supposedly un-mountainous course, this is a Tour for Wiggins to lose, so dominant has he become in 2012, and so easily did he win the Dauphiné. But that does not mean he’ll win as easily as I first thought, back in May…for the mountains of the 2012 route are harder than most people realise.

As defending champion of Le Tour, Evans chances of a repeat victory would seem to be reduced following his quieter-than-before season to-date, and a time loss to Wiggins of 1’ 26” in the recent Dauphiné. But in that Dauphiné I saw the emergence of a new Evans, a more canny one who is enjoying the lack of attention on him while quietly getting himself very much in shape for the Tour. In 2011, Evans won the Tour exactly in the way he’d planned to, by keeping out of trouble, by covering all the moves in the Pyrenees, by crushing the threat of Andy Schleck in the Alps – and then delivering the coup-de-grace in the long Grenoble TT. As such, Evans won the 2011 Tour with a relative ease, and the world never saw the reserves the Australian had held back. I think this year’s race will see the ‘other’ Evans, a man who enjoyed the fame his victory brought him in 2011 and who is determined to win again, even if he has to win from behind.

Evans could look to Gesink for a co-operative climbing challenge against Wiggins, for the Dutchman has made such vast improvements in his time trialling that a podium place is well within reach if he can also create a few climbing opportunities along the way. Winner of the Tour of California this May, and a fine 5th in the long TT of the recent Tour de Suisse, Gesink is one of the few favourites to possess a ‘kick’ when he climbs flat-out. It is this advantage that should place Gesink above Leipheimer, a man who’s gradually coming to-form after an injury-ruined season but who lacks that extra ‘zip’ on the climbs. Sanchez will want to be at least the best Spaniard, and craves a top-three spot in Paris to go with his Olympic Gold medal of 2008. While Hesjedal, winner of the Giro and a man who’s still discovering himself late in life, will want to show his Italian success was no fluke – which it wasn’t. Trying to predict an entire top-10 of a Tour is impossible, but expect a Frenchman – Pierre Rolland; a Belgian – Maxime Monfort; a Luxemburger – Frank Schleck; and an Italian – Vincenzo Nibali – to be up there at the sharp-end of the game. Then there’s Spain’s Alejandro Valverde, back from his drug-enforced ban and eager to make a point to his rivals and critics – he too might make the top-ten in Paris.

So strong is Team Sky that a co-ordinated effort against them in the mountains is the only way to isolate and unsettle Wiggins to the point that he becomes, perhaps, vulnerable. Yet at the Dauphiné, Sky didn’t just resist the many attacks made against them in the Alps – they saved their best until last by placing four of their top men with Wiggins on the race’s hardest ascent, the Joux-Plane. In doing so, they laid down a marker for the Tour, a kind of intimidation for their rivals. Still, a closer look at this year’s Tour route reveals that it is much tougher than people realise, and that Sky will either reign supreme or break apart with the pressure of expectation upon them. The four Vosges/Alpine stages are split by the 41-kilometre TT at Macon, and unless Sky have let a lucky escape go clear in that first week, Wiggins is likely to be in control for those Alpine stages – for that’s the way he and his team want to race this Tour. But the Pyrenean stages - 14, 16 and 17 – offer a tougher proposition after two weeks racing, and with the longer 53-kilometre TT still to come. With these last mountain stages close to Spain, a habitual motivation for that country’s cyclists to do well, Sky can expect assaults from Movistar and Euskatel, with surreptitious support from the few Spanish cyclists still racing on ‘foreign’ teams. I envisage Sanchez and Valverde working in unison against Wiggins, with the ‘other’ Sanchez – Luis Leon - sending his Rabobank troops into the battle, a move that will also benefit Gesink.

Can Wiggins be defeated? Yes, of course, but huge lessons have been learnt since he crashed out in 2011, and his team has been re-inforced almost to the point of invincibility. Wiggins’ teamates will make sure they keep him in front this time around, make sure he isn’t allowed to lose concentration and drift back into the middle of the peloton like he did last year. Sky will have learnt a lot from the way BMC rode at the front for Evans in 2011, keeping their man clear of most dangers until the mountains made their natural selection in the peloton. Wiggins is strong enough to ride at, or near, the front for three weeks. He’s fast enough to outpace all his rivals in the TTs, and he’s trained so much at altitude in the mountains, that there is likely nothing that scares him. But a bad day awaits even the greatest champions if little things start to go wrong. Some people say Sky is too organised, too controlled - too perfect. Such an outfit could be toppled if their perfect-plan gets compromised, and they also have Mark Cavendish to consider as well.

If it is so hard to predict the way this Tour will be raced, imagine how the teams make their plans? Tactics planned overnight might need to be changed if a rider falls ill or crashes, or if rival teams make an unexpected move, obliging everyone to throw their plans out of the window and start anew. There are so many side shows to the main event, either one of them could change the way the race is run. Most French hopes will be on Thomas Voeckler to repeat what he did in 2011 by escaping on a ‘transitional’ stage but gaining enough time to take the race-lead and, almost, defending it to the end. No-one expects Voeckler to be allowed to go away this time, but if he does then it might change an entire week’s racing. Schleck is an interesting cyclist, and will almost certainly go on the attack in the Pyrenees if he’s lost a fair few minutes in that Macon TT – he too could spoil the plans of many a team. But it is the Points competition that carries the greatest speculation, for it involves Sky and Cavendish in their quest to win a second Green Jersey for the sprinter.

The Tour has retained its one-sprint-per-day competition that Cavendish used to win last year’s Green Jersey. The Manxman would be lead-out by his then Columbia team, take the flying sprint, and either sit up for the rest of the day or prepare himself for the finish-sprint as well. But with Sky’s eyes more focussed on winning the Yellow Jersey, Cavendish may have to fend for himself a lot more this July, unless he builds up some early advantage in the competition and obliges his team to balance their loyalties. The 2012 Tour sees the debut of Peter Sagan, a raw talent from Slovakia who can climb hills almost as well as he can sprint. It is not just the likes of Greipel, Rojas, Farrar, Petacchi or Renshaw who threaten Cavendish – it is Sagan and his ability to get to those flying sprints ahead of the sprinters, and even take a stage-win or two if there’s an uphill finale to help him. If Cavendish finds himself with a hefty deficit after week one, I fully expect Sky to switch him to a helping role – literally a domestique – to re-inforce the chances of Wiggins. In return, Cavendish will earn 100-percent of Wiggins’s support in the Olympic Games road race. Now that’s not a bad asset to have.

As always, I’ll go to this Tour full of excitement at the prospects ahead. I am British, and would love to see Wiggins win for Great Britain – especially in this London Olympic year. I’d love to see Cavendish win the Green Jersey too – even though that would mean covering up his glorious Rainbow Jersey. But my eyes and hopes are spread further afield than just British cyclists and teams. I’d love to see Evans challenge Wiggins and even win – for that would make for a great Tour, and prove what a truly great cyclist the Australian really is. And I could actually enjoy seeing Voeckler win for France – now that would really change the face of the Tour in its host country. You see, like it or not, the Tour de France is what we all live for each year. It dominates our lives in a way that only becomes apparent when the race actually starts. Races before or afterwards pale into a respectful sort of insignificance - they entertain us but merely form the pecking order of races that make the Tour seem so powerful.

And of course, the Tour is so much more than a bike-race. When I’m not working with my camera, or passing too many hours editing the 500 images I retain each day, I’ll be keeping an eye on which restaurant tempts me the most, which bottle of wine catches my eye, and if my fellow-travellers are enjoying themselves as much as me. No, they couldn’t possibly be! Vive Le Tour, vive La France – it’ll soon be coming your way! I’ll be taking just about every bit of camera gear I own, for the Tour gives off many more photo opps’ than any other race, and I would not want to be lacking in any department. Two Nikon D4 bodies, six lenses - ranging from a 16mm Fisheye to a 200-400mm zoom – two flash units, a spare D3 body, an iPad, a battery pack, a lap-top, cables, connectors, an iPad and a piece of chamois leather to clean everything. Now that’s before I even think about what clothing to cram into my already overladen bags! Yet this three weeks will pass so quickly I won’t even have time to consider such banalities as what to wear each evening. The Tour eats up every living minute of one’s day, and most of the night as well. Yet five days after the Tour ends, I’ll be trekking into London for the Olympic Games road race. So maybe only in October will I be able to consider if the 2012 Tour was a great one, or merely a good one. GW

Labels:

art and architecture,

cycling

Wednesday, June 27, 2012

Tuesday, June 26, 2012

Time Lapse Night Sky

http://exp.lore.com/post/25892078490/a-breathtaking-timelapse-visualization-of-the

Labels:

art and architecture

Monday, June 25, 2012

...from Dr. John

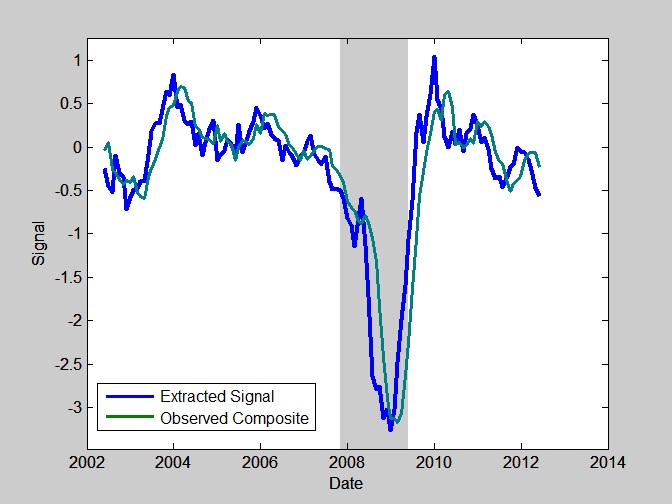

"...our measures of leading economic pressures have indicated the likelihood of an oncoming U.S. recession. Our view is based on the analysis of leading/coincident/lagging indicators (see Leading Indicators and the Risk of a Blindside Recession) as well as more statistical signal processing methods that extract "unobserved components" from noisy data (see the note on extracting economic signals in Do I Feel Lucky?). As Lakshman Achuthan at the ECRIhas noted on the basis of different but related evidence, the verdict has been in for a while. The interim has been little more than waiting for the coincident data to catch up to the leading evidence that is already in place."

"This wait is by no means over. As Achuthan has observed, economic data such as GDP and employment data are heavily revised over time. Very often, the first real-time negative GDP print occurs about two quarters after the recession actually begins. It is only later that the data are revised to show an earlier downturn. For that reason, it's important to pay attention to the joint action of numerous economic data points, rather than selecting any specific indicator as an "acid test." The joint evidence suggests that the U.S. economy has entered a recession that will later be marked as having started here and now."

"The following chart shows the most leading economic component (blue) that we infer from a broad composite of economic indicators. This component has a lead of several months, relative to broadly observed economic data. Importantly, even the observable data has now predictably turned down, as evidenced for example by the "surprising" weakness in the Philly Fed data last week. We expect further weakening in employment data, coupled with an abrupt dropoff in industrial production and new orders."

"Once again, the weakness developing in the most leading components of U.S. data closely reflects what we're already seeing in European data. Last week, Markit reported that European output continues in its steepest contraction since 2009. The path of the Flash Eurozone Purchasing Managers Index (PMI) gives a fairly good indication of what we're likely to observe in less-timely GDP figures as they are released in the coming months. Meanwhile the HSBC China PMI has also dropped below the 50 level that distinguishes expansion from contraction, with the China Manufacturing Output Index falling to 49.1, and the China Manufacturing PMI falling to 48.1."

..."Since we try to align our investment exposure with the return/risk that we estimate at each point in time, we really don't a need to make specific predictions, other than to frame our position within what we see as a larger context. Still, my opinion aligns fairly well with what veteran analyst Richard Russell observed last week: "I'm fairly convinced that this is a legitimate primary bear market. And it will end the way all major bear markets end -- with good stocks being tossed into the market for whatever price they may bring. The good stocks will be sold last, because there will, at least, be a market for them. They will sell below known value."

Importantly, when Russell says "below known value" he means "below levels that investors presently find familiar" - not valuations that are particularly unusual from the standpoint of long-term historical experience. Russell puts the likely downside from here in a fairly wide range that works out to between 28%-56% lower. Given that our own estimates of "fair value" are in the 850-950 range for the S&P 500, and we certainly can't rule out an overshoot (which is typical historically), Russell's range isn't particularly extreme. At the high end of Russell's range, we estimate that the 10-year projected return for the S&P 500 would be about 9% annually, which is still below the historical norm. At the low end of the range, the 10-year projected return would be about 14.7%, which would be more unusual, but still well below the projected returns that were available between 1973-1984 and the bulk of the period between 1940-1954. It's not a narrow range by any means, but it isn't kind to the notion that the worst potential downside for the market is limited to 10-15%"

http://www.hussman.net/wmc/wmc120625.htm

Labels:

Central Banks,

Economy,

Markets

The Great Abdication

By PAUL KRUGMAN

Published: June 24, 2012Among economists who know their history, the mere mention of certain years evokes shivers. For example, three years ago Christina Romer, then the head of President Obama’s Council of Economic Advisers, warned politicians not to re-enact 1937 — the year F.D.R. shifted, far too soon, from fiscal stimulus to austerity, plunging the recovering economy back into recession. Unfortunately, this advice was ignored.

But now I’m hearing more and more about an even more fateful year. Suddenly normally calm economists are talking about 1931, the year everything fell apart.

It started with a banking crisis in a small European country (Austria). Austria tried to step in with a bank rescue — but the spiraling cost of the rescue put the government’s own solvency in doubt. Austria’s troubles shouldn’t have been big enough to have large effects on the world economy, but in practice they created a panic that spread around the world. Sound familiar?

The really crucial lesson of 1931, however, was about the dangers of policy abdication. Stronger European governments could have helped Austria manage its problems. Central banks, notably the Bank of France and the Federal Reserve, could have done much more to limit the damage. But nobody with the power to contain the crisis stepped up to the plate; everyone who could and should have acted declared that it was someone else’s responsibility.

And it’s happening again, both in Europe and in America.

Consider first how European leaders have been handling the banking crisis in Spain. (Forget about Greece, which is pretty much a lost cause; Spain is where the fate of Europe will be decided.) Like Austria in 1931, Spain has troubled banks that desperately need more capital, but the Spanish government now, like Austria’s government then, faces questions about its own solvency.

So what should European leaders — who have an overwhelming interest in containing the Spanish crisis — do? It seems obvious that European creditor nations need, one way or another, to assume some of the financial risks facing Spanish banks. No, Germany won’t like it — but with the very survival of the euro at stake, a bit of financial risk should be a small consideration.

But no. Europe’s “solution” was to lend money to the Spanish government, and tell that government to bail out its own banks. It took financial markets no time at all to figure out that this solved nothing, that it just put Spain’s government more deeply in debt. And the European crisis is now deeper than ever.

Yet let’s not ridicule the Europeans, since many of our own policy makers are acting just as irresponsibly. And I’m not just talking about Congressional Republicans, who often seem as if they are deliberately trying to sabotage the economy.

Let’s talk instead about the Federal Reserve. The Fed has a so-called dual mandate: it’s supposed to seek both price stability and full employment. And last week the Fed released its latest set of economic projections, showing that it expects to fail on both parts of its mandate, with inflation below target and unemployment far above target for years to come.

This is a terrible prospect, and the Fed knows it. Ben Bernanke, the Fed’s chairman, has warned in particular about the damage being done to America by the unprecedented level of long-term unemployment.

So what does the Fed propose doing about the situation? Almost nothing. True, last week the Fed announced some actions that would supposedly boost the economy. But I think it’s fair to say that everyone at all familiar with the situation regards these actions as pathetically inadequate — the bare minimum the Fed could do to deflect accusations that it is doing nothing at all.

Why won’t the Fed act? My guess is that it’s intimidated by those Congressional Republicans, that it’s afraid to do anything that might be seen as providing political aid to President Obama, that is, anything that might help the economy. Maybe there’s some other explanation, but the fact is that the Fed, like the European Central Bank, like the U.S. Congress, like the government of Germany, has decided that avoiding economic disaster is somebody else’s responsibility.

None of this should be happening. As in 1931, Western nations have the resources they need to avoid catastrophe, and indeed to restore prosperity — and we have the added advantage of knowing much more than our great-grandparents did about how depressions happen and how to end them. But knowledge and resources do no good if those who possess them refuse to use them.

And that’s what seems to be happening. The fundamentals of the world economy aren’t, in themselves, all that scary; it’s the almost universal abdication of responsibility that fills me, and many other economists, with a growing sense of dread

.

.

A version of this op-ed appeared in print on June 25, 2012, on page A19 of the New York edition with the headline: The Great Abdication

http://www.nytimes.com/2012/06/25/opinion/krugman-the-great-abdication.html?hp

Labels:

Central Banks,

Economy

Thursday, June 21, 2012

25 Top Financial Reporters

Downtown Josh Brown's 25 top financial reporters...Max, Tyler, Chris, Ritholtz, Heidi, Lauren, etc...

http://www.huffingtonpost.com/mobileweb/joshua-m-brown/best-financial-journalists_b_1605584.html

Tuesday, June 19, 2012

...from Jeffery Saut

"Stephen Moore wrote a Wall Street Journal article entitled, “Atlas Shrugged: From Fiction to Fact in 52 Years.” For those of us familiar with Ayn Rand’s classic book (Atlas Shrugged), recent events eerily mirror her writings about the economic carnage caused by big government running amok. As Mr. Moore wrote:

For the uninitiated, the moral of the story is simply this: Politicians invariably respond to crises – that in most cases they themselves created – by spawning new government programs, laws and regulations. These, in turn, generate more havoc and poverty, which inspires the politicians to create more programs ... and the downward spiral repeats itself until the productive sectors of the economy collapse under the collective weight of taxes and other burdens imposed in the name of fairness, equality and do-goodism.

In the book, these relentless wealth redistributionists and their programs are disparaged as ‘the looters and their laws.’ Every new act of government futility and stupidity carries with it a benevolent-sounding title. These include the ‘Anti-Greed Act’ to redistribute income and the ‘Equalization of Opportunity Act’ to prevent people from starting more than one business (to give other people a chance). My personal favorite, the ‘Anti Dog-Eat-Dog Act,’ aims to restrict cut-throat competition between firms and thus slow the wave of business bankruptcies.

President Ronald Reagan was the first to suggest that the nine most terrifying words in the English language are, “I’m from the government and I’m here to help.” President Reagan also stated, “Government is not the solution to our problem; government is the problem.” Even President Clinton promised smaller government, but that promise ended on November 4, 2008 as voters elected President Barack Obama, ushering in an era of expanded government that Ayn Rand warned of 52 years ago (as a sidebar, we suggest watching this two-minute blurb from Milton Friedman – http://pajamasmedia.com/instapundit/69117/). Yet, last week may have marked a historic shift in the country’s ideological direction after Governor Scott Walker’s resounding win in Wisconsin’s recall vote.

Now I am not a Tea Party person, but since the historic mid-term elections I have argued the Tea Party surfaced what Adam Smith wrote about in the book “The Wealth of Nations.” To wit – the political corruption that prevents prosperity – and that is exactly what we’ve got, the best Congress (the House and Senate) money can buy. Yet, that seems to be changing punctuated by last week’s Wisconsin vote. However, the footings of the sea change began two years ago with the mid-term election where the majority of those elected were not professional politicians but rather came from the private sector. Moreover, if you talk to those newbies they will tell you they don’t really want to be in Washington, but they think the country is off course and they want to try and reverse that course. I think this is a trend toward more practical leaders that will offer simple and pragmatic solutions to our country’s ills rather than recondite laws like the aforementioned “Anti-Greed Act;” and, I think that is bullish for the stock market."

http://www.raymondjames.com/inv_strat.htm

Monday, June 18, 2012

...from Dr. John

"As I noted in March 2008, at a similar point in the crisis cycle: "Think of it this way. A liquidity crisis is when you write a check for more than the amount in your checking account. You suddenly realize that you need to sell a big securities position to cover it, but selling everything at once might only get you "fire sale" prices. In this case, you need a loan for a few weeks to give you time to work out of your securities position. Without that short-term "liquidity," the check might bounce even though you really do have the assets to pay it off. In contrast, a solvency crisis is when the only asset you have to cover that check is an IOU from your Uncle Ernie, who keeps promising "I'll pay you every dime as soon as I win it back on the ponies."

Government always faces a "fiscal constraint" in that spending can only be financed in one of three ways: tax revenue, bond issuance, or money printing. In the "money printing" option, the government first issues debt, but the central bank permanently buys that debt and permanently creates currency. So a permanent purchase of debt by the central bank is effectively a fiscal operation - a solvency operation. In contrast, a liquidity operation involves a temporary purchase of government debt by the central bank, which creates new currency and bank reserves. But to be a liquidity operation, that operation must also be subsequently reversed so the government debt doesn't permanently reside on the central bank's balance sheet, and so that the money supply isn't permanently elevated.

Understanding this, it becomes clear that even coordinated central bank liquidity operations are at best a short-term response to European crisis. Indeed, even money printing by the European Central Bank itself can only address Europe's solvency crisis if it buys peripheral European debt without ever being repaid, and permanently creates new euros to do it. Indeed, at prevailing debt/GDP ratios, it is unlikely that the ECB would ever be able to reverse massive purchases of peripheral European debt without provoking a fresh crisis. It follows that massive purchases of peripheral debt would amount to an implied fiscal transfer from other European countries, since normally, all European countries would share in the "seignorage" revenue from new money creation. Not to mention that EU treaties would have to be changed to allow the ECB to rescue individual countries.

So the idea of a quick fix through ECB printing is an illusion - that solution would still effectively represent a massive fiscal transfer from other European countries, because the creation of new euros would otherwise be able to fund new spending within the Euro zone. Massive, permanent money creation might "save the euro" in its present form, but would also wreck the euro in substance through inflation and depreciation. The political decision is whether the people of Germany and stronger European countries want the euro enough to make permanent fiscal transfers (or permanent currency creation that amounts to the same thing) to peripheral European countries. The real fate of the euro rests with that political decision, not with central banks, and the final decision on that matter will not come without extreme disruption in any event. Maintaining the Euro will require European governments to cede their fiscal sovereignty to a central authority, and that will not be easy unless major disruptions make that choice better than the alternatives. Departing from the Euro would best be done in sequence from stronger-to-weaker (which would free the remaining countries to agree on whatever depreciation and inflation rate they choose), rather than weaker countries first, but any breakup path would be disruptive as well. The realistic perspective here is to accept the likelihood of significant and continuing disruptions from Europe, and to accept various investment risks within that context."

http://www.hussman.net/wmc/wmc120618.htm

Saturday, June 16, 2012

Insert your favorite Euro here "blank" is not Greece...

1. “Spain is not Greece.”

Elena Salgado, Spanish Finance minister, Feb. 2010

2. “Portugal is not Greece.”

The Economist, 22nd April 2010.

The Economist, 22nd April 2010.

3. “Ireland is not in ‘Greek Territory.’”

Irish Finance Minister Brian Lenihan.

Irish Finance Minister Brian Lenihan.

4. “Greece is not Ireland.”

George Papaconstantinou, Greek Finance minister, 8th November, 2010.

George Papaconstantinou, Greek Finance minister, 8th November, 2010.

5. “Spain is neither Ireland nor Portugal.”

Elena Salgado, Spanish Finance minister, 16 November 2010.

Elena Salgado, Spanish Finance minister, 16 November 2010.

6. “Neither Spain nor Portugal is Ireland.”

Angel Gurria, Secretary-general OECD, 18th November, 2010.

Angel Gurria, Secretary-general OECD, 18th November, 2010.

7. "Spain is not Uganda"

Rajoy to Guindos... Last weekend!

Rajoy to Guindos... Last weekend!

8. "Italy is not Spain"

Ed Parker, Fitch MD, 12 June 201

Ed Parker, Fitch MD, 12 June 201

http://www.zerohedge.com/news/definitive-lesson-new-normal-european-geography

Labels:

Central Banks,

Currency Wars,

Finance,

Fraud,

GIB,

humor

Friday, June 15, 2012

Thursday, June 14, 2012

Wednesday, June 13, 2012

Ron and Ayn

How Ayn Rand and L. Ron Hubbard Came Up With Their Big Ideas -- powered by Cracked.com

Labels:

GIB,

humor,

Libertarianism

Tuesday, June 12, 2012

Monday, June 11, 2012

Sunday, June 10, 2012

The creators of the Flame malware have sent a "suicide" command that removes it from some infected computers.

Security firm Symantec caught the command using booby-trapped computers set up to watch Flame's actions.

Flame came to light after the UN's telecoms body asked for help with identifying a virus found stealing data from many PCs in the Middle East.

New analysis of Flame reveals how sophisticated the program is and gives hints about who created it.

Clean machine

Like many other security firms Symantec has kept an eye on Flame using so-called "honeypot" computers that report what happens when they are infected with a malicious program.

Described as a very sophisticated cyber-attack, Flame targeted countries such as Iran and Israel and sought to steal large amounts of sensitive data.

Earlier this week Symantec noticed that some Flame command and control (C&C) computers sent an urgent command to the infected PCs they were overseeing.

Flame's creators do not have access to all their C&C computers as security firms have won control of some of them.

The "suicide" command was "designed to completely remove Flame from the compromised computer," said Symantec.

The command located every Flame file sitting on a PC, removed it and then overwrote memory locations with gibberish to thwart forensic examination.

"It tries to leave no traces of the infection behind," wrote the firm on its blog.

Analysis of the clean-up routine suggested it was written in early May, said Symantec.

Crypto crash

At the same time, analysis of the inner workings of Flame reveal just how sophisticated it is.

According to cryptographic experts, Flame is the first malicious program to use an obscure cryptographic technique known as "pre-fix collision attack". This allowed the virus to fake digital credentials that had helped it to spread.

The exact method of carrying out such an attack was only demonstrated in 2008 and the creators of Flame came up with their own variant.

"The design of this new variant required world-class cryptanalysis," said cryptoexpert Marc Stevens from the Centrum Wiskunde & Informatica (CWI) in Amsterdam in a statement.

The finding gives support to claims that Flame must have been built by a nation state rather than cybercriminals. It is not clear yet which nation created the program.

http://www.bbc.co.uk/news/technology-18365844

The Most Sophisticated Cyberweapon Yet?

By Chris Wood, Senior Analyst

"It pretty much redefines the notion of cyberwar and cyberespionage."

That's a quote from experts at the Russia-based antivirus firm Kaspersky Lab regarding malware they recently discovered while trying to determine what was deleting sensitive information from computers across the Middle East for the UN's International Telecommunication Union. While searching for that code, nicknamed Wiper, the group discovered a new, more insidious, malware codenamed Worm.Win32.Flame.

More on that new malware, simply dubbed "Flame," in a moment. First, some background on the state of cyberwar today. For starters it's important to recognize that although no cyberwar has ever been declared, cyberwarfare is now a part of life. The war is pervasive and we are all vulnerable to attack.

It's impossible to say who fired the first "shot" in this war, but the US government has certainly stepped up the fight. The New York Times recently came out with a report detailing how President Obama accelerated cyberattacks (begun during the Bush administration) on the computer systems that run Iran's nuclear enrichment facilities. The worm that the US (in conjunction with Israel) created to carry out the attacks accidentally became public in the summer of 2010; a programming error allowed it to escape its target in Iran, and it was discovered by computer security experts. They named it Stuxnet.

The cat was out of the bag. But it was still just speculation at the time that the US and Israel were behind the worm. In the weeks that followed, Iran's Natanz plant was hit by a newer version of Stuxnet, and then another after that. According to David Sanger of the New York Times, "The last of that series of attacks, a few weeks after Stuxnet was detected around the world, temporarily took out nearly 1,000 of the 5,000 centrifuges Iran had spinning at the time to purify uranium."

As far as we know, Stuxnet was the US's first sustained use of cyberweapons; the attacks marked the first time that a computer worm was used to cause physical damage, prompting many to call Stuxnet the most sophisticated piece of malware that had ever been crafted.

Enter Flame.

According to the experts at Kaspersky Lab, "Flame can easily be described as one of the most complex threats ever discovered. It's big and incredibly sophisticated." It's a back door, a Trojan, and has wormlike features, which allow it to replicate in a local network and on removable media if instructed. At almost 20MB in size when fully deployed, it dwarfs Stuxnet (which is 50 times larger than the typical worm) in size. And it's been infecting systems in parts of the Middle East and North Africa for at least two years.

Flame is a sophisticated attack toolkit that spies on the users of infected systems by sniffing network traffic, taking screenshots, recording keystrokes, and even recording audio conversations by turning on computer microphones remotely. Another impressive feature of Flame is its ability to use enabled Bluetooth devices to collect information about discoverable devices near the infected machine. The malware is also a platform capable of receiving and installing various modules for different goals. It allows operators to upload further plugins which expand Flame's functionality through a back door. There are about 20 modules in total; the purpose of most of them is still being investigated.

While Flame is similar to Stuxnet in that both are the product of highly advanced programming and detailed expertise in many specialized areas which use specific software vulnerabilities to target selected systems, it differs from Stuxnet in some important ways. Stuxnet was designed specifically for the purpose of infiltrating and wreaking havoc on the centrifuges at Iran's Natanz nuclear enrichment facility. At least part of Flame's purpose appears to be more broad-based in nature - as a general purpose tool for cyberespionage. Once Flame captures the data it's looking for, it compresses and encrypts the information and then holds it until it has a reliable connection to send it to its command and control servers.

By virtue of its general cyberespionage purpose, Flame is much more widespread than Stuxnet. Researchers have detected Flame on hundreds of computers throughout the MENA region and suspect that the total number of infections could be more than a thousand. The top affected areas are Iran, Israel, Palestine, Sudan, Syria, Lebanon, Saudi Arabia, and Egypt.

It's not yet known who is behind Flame, since no information in the code has been discovered that can tie it to its authors. But, like Stuxnet, Kaspersky Lab believes it is the product of a nation-state.

[Ed. Note: Some computer security firms say that Kaspersky has hyped Flame, and that it's too early to call it a cyberweapon. Whether the skepticism is warranted or a result of jealousy remains to be seen. But what can't be contested are the skills of the researchers at Kaspersky Lab.]

At this point you might be saying, "Well that's both kind of scary and cool, but so what? What's the point? How does it affect me?"

The point is that the genie is out of the bottle, and there's no going back. Unlike in a traditional war, in a cyberwar it's the more developed nations that are the most vulnerable to attack. When Flame was designed, the programmers did not employ "code obfuscation," which is a fancy way of saying that they didn't try to disguise the code in any way that would make it difficult to reverse engineer, like a commercial software developer would have. According to Fred Guterl from Scientific American, "Stuxnet code was not protected against reverse engineering, either, but this is less of problem because its purpose is narrow and hence the programming is less useful as a weapon than the more general-purpose Flame." This, coupled with the fact that the US has recently been so brazen in its cyberwar efforts, virtually ensures an increase in cyberattacks against the US government and US businesses.

Alan Paller, director of research at the SANS Institute, said that the revelation of US involvement in Stuxnet dramatically altered the cybersecurity landscape:

"The public airing of the US involvement in Stuxnet is going to make others bolder about launching similar attacks against the country using the same kind of tactics and cyber weapons. We are now going to be the target of massive attacks."

The takeaway for US businesses should be that they need to pay more attention to securing their networks.

The takeaway for investors should be that with the proliferation and increasing sophistication of cyberthreats, there will be growing demand to protect against it. As the weapons in this cyberwar evolve, so too must the defenses against them. And that's big business.

As Intel CEO Paul Otellini said, "We have concluded that security has now become the third pillar of computing, joining energy-efficient performance and Internet connectivity in importance."

Otellini hit the nail on the head. And investors are already capitalizing on the huge growth that will come in this area over the coming decades. Estimates of the total market opportunity vary widely, but to get some sense, Canalys recently announced the results of its latest enterprise security forecasts, which indicate that the market is expected to grow to about $23 billion worldwide this year. Steady, double-digit growth is projected for years to come.

As one example of the gains that can be had by investing in this space, Casey Extraordinary Technology subscribers were rewarded with a one-week return of nearly 50% in August of 2010 when we recommended buying ArcSight Inc., which developed monitoring software to seek out nefarious code or malicious insiders that had breached a company's firewall. Just seven days after our recommendation, news of a potential buyout of the company by HP, at a 50% premium, caused the shares to pop and we exited with a huge gain.

Another example: One of our core portfolio holdings which operates in the network security space is up almost 170% since we bought in just two years ago.

Not all the computer and network security firms out there are gems, but given all the money that's necessarily going to be pumped in to these industries in the coming years, it behooves you as an investor to investigate the options.

Casey Research

Labels:

life,

reference,

technology

Saturday, June 9, 2012

Science Paper Translations

"It has long been known" = I didn't look up the original reference.

"A definite trend is evident" = These data are practically meaningless.

"While it has not been possible to provide definite answers to the questions" = An unsuccessful experiment, but I still hope to get it published.

"Three of the samples were chosen for detailed study" = The other results didn't make any sense.

"Typical results are shown" = This is the prettiest graph.

"These results will be in a subsequent report" = I might get around to this sometime, if pushed/funded.

"In my experience" = once.

"In case after case" = twice.

"In a series of cases" = thrice.

"It is believed that" = I think.

"It is generally believed that" = A couple of others think so, too.

"Correct within an order of magnitude" = Wrong.

"According to statistical analysis" = Rumor has it.

"A statistically oriented projection of the significance of these findings" = A wild guess.

"A careful analysis of obtainable data" = Three pages of notes were obliterated when I knocked over my coffee.

"It is clear that much additional work will be required before a complete understanding of this phenomenon occurs"= I don't get it.

"After additional study by my colleagues"= They don't get it either.

"Thanks are due to Joe Blotz for assistance with the experiment and to Cindy Adams for valuable discussions" = Mr. Blotz did the work and Ms. Adams explained to me what it meant.

"A highly significant area for exploratory study" = A totally useless topic selected by my committee.

"It is hoped that this study will stimulate further investigation in this field" = I quit

Friday, June 8, 2012

Venus Transit HD

Labels:

art and architecture,

life,

science,

technology,

Waves

Thursday, June 7, 2012

Wednesday, June 6, 2012

Tuesday, June 5, 2012

Richard Russell - Dow Theory Primary Trend Change Confirmation - Bear Market Ahead

Richard Russell - “How far will the bear market carry? No one knows. Already all of 2012's gains have been wiped out. There's a number down there to where the bear market is heading. I don't know what that number is. Dow 8,000? Dow 6,000? Dow 4,000? Dow 2,500?”

“The number could be any one of these. What I hope is that we get to that number as quickly as possible. I just hope we get the pain of the bear market over as fast as possible. One mistake is to think we know how costly the bear market is fated to be -- and how far the bear market will carry. The Primary trend is a law unto itself. It will continue until it dies of exhaustion.

In the meantime, the bear market goes on. I'm afraid it has a long way to go. But we will survive. In all seriousness, I feel it is my duty to help my subscribers to survive and weather this bear market.

DANGER -- A primary bear market has been signaled according to Dow Theory. On May 1 the Dow Industrials rose to a high of 13,279.32. The Transports failed by a wide margin to confirm. The two Averages then turned down and broke below their April lows. Under Dow Theory, this was confirmation that a primary bear market is in progress.

As so often happens, the bear signal arrived at a time when the stock market was acutely oversold. Most bear markets wipe out a half to two-thirds of the preceding bull market. As a rule, the more froth the bull market generates, the nastier the bear market that follows.

Major bear market declines can be extended and even tedious, while the rallies or counter-moves can come unexpectedly and are often rapid and violent (the violence is usually a result of frantic short-covering by traders who are trapped by the rally).

I want to reiterate that bear markets tend to be deceptive and not usually given to logical analysis. One reason for this is that bear markets operate within a background of naked fear. Two emotions rule the market -- Fear and greed. Of the two, fear is the stronger of the two -- because the specter behind the fear is LOSS. Greed is also a strong emotion, but fear of loss trumps the desire for gain.”

Russell also added: “Gold is finally above 1600 again, and I think it has moved into a buying range. I no longer see a BIG correction ahead for gold. As the euro and other junk fiat currencies weaken, there will be more and more buyers of gold -- including confused central banks.

Retail sentiment for gold is now low, which is bullish for the metal. I've been sitting with all my gold and paper gold. I've been determined that I'm not going to be knocked out.

http://bit.ly/KLue3v

http://bit.ly/KLue3v

Monday, June 4, 2012

Sunday, June 3, 2012

Saturday, June 2, 2012

The End Game

Raoul Pal expects a series of sovereign defaults, the "biggest banking crisis in world history", and asserts that we don't have many options to stop it.

Pal previously co-managed the GLG Global Macro Fund. He is also a Goldman Sachs alum. He currently writes for The Global Macro Investor, a research publication for large and institutional investors.

The End Game

Friday, June 1, 2012

Subscribe to:

Posts (Atom)