Axel Merk, Portfolio Manager, Merk Funds

October 4, 2011

"Is Operation Twist a failure? The stock market plunged in disappointment when it was announced. Keynesians are tearing their hair out in frustration, as it appears the Fed failed to ramp up the printing press. Free marketers are disgusted by the blatant manipulation of the yield curve. A number of Federal Reserve (Fed) President Bernanke’s colleagues dissented and/or are voicing public opposition. However, as the dust settles, it appears there is a method to the twist: Bernanke may have a plan…

|

|

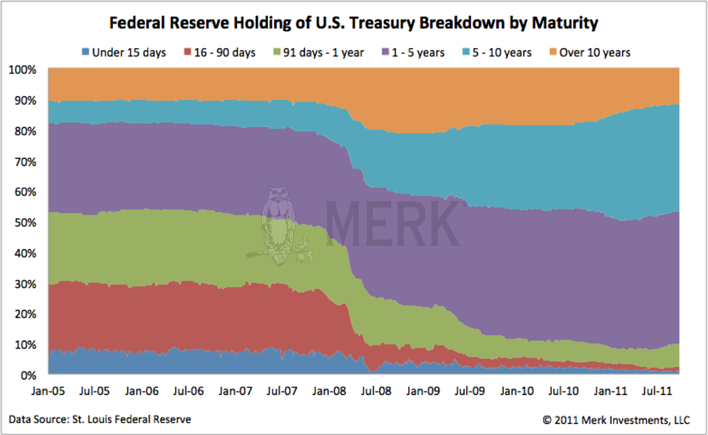

To understand where we may be heading, let’s look at where we have come from. Below is a graphical depiction of the Federal Reserve’s holdings of Treasury securities on its balance sheet; the different colors represent the evolving composition of the maturity of assets held by the Fed:

One does not need to be an economist to see that the Fed has already been “twisting” its holdings of Treasury securities. It used to be that over 50% of Treasuries held by the Fed had a maturity of less than a year. That portion has already shrunk dramatically. Operation Twist is going to focus on the purple shading, replacing many of these securities with longer-dated ones. Differently said, Operation Twist really is nothing new, but an extension and expansion of policies in place since 2008.

Indeed, Bernanke has a playbook, hiding in plain sight: in his 2002 speech that earned Bernanke his nickname as “Helicopter Ben”, he laid out his plan when faced with the threat of deflation. Whereas his predecessor Paul Volcker took years to convince the markets that the Fed was serious about fighting inflation, Bernanke appears to be relentless in trying to convince the markets that deflation is not going to happen in his back yard. But why not simply print more money as the economy has slowed (engage in “QE3”)?

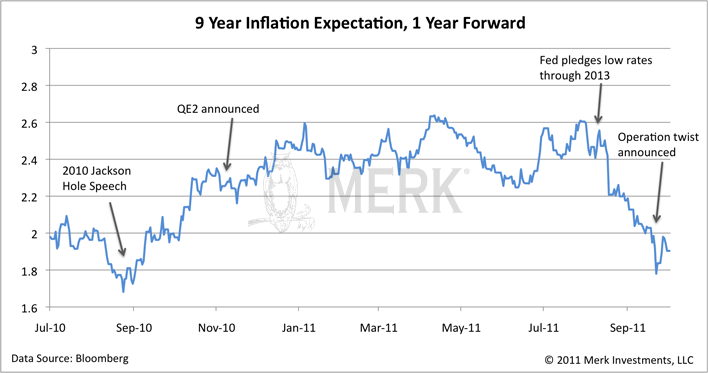

It looks like Bernanke at least wants to maintain the appearance of keeping long-term inflation expectations low. Earlier this year, Bernanke complained a few times that the risk-reward ratio of another round of easing is not all that clear. Well, how about making it clearer, by:

- First crushing the short end of the yield curve by committing to keep interest rates low until the middle of 2013.

- Then lower long-term interest rates by initiating “Operation Twist”, the selling of short-term securities by the Fed in the billions, then reinvesting the proceeds in long-term securities.

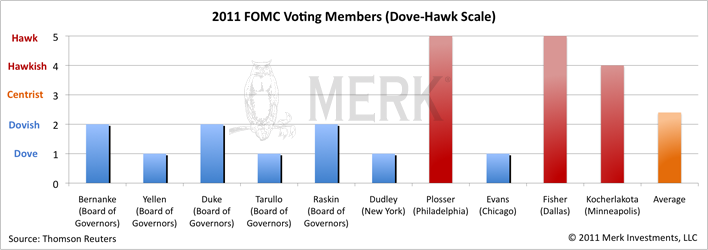

What this chart shows is that recent communication and action by the Fed may have contributed to an environment closer to where Bernanke would like to see: with inflation expectations low, Bernanke is back in familiar territory, able to print more money. A reason why the Fed first needed to set the stage is because the Federal Open Market Committee (FOMC) has a couple of outspoken hawks1 that, as we have alluded to, are not afraid to voice their dissent:

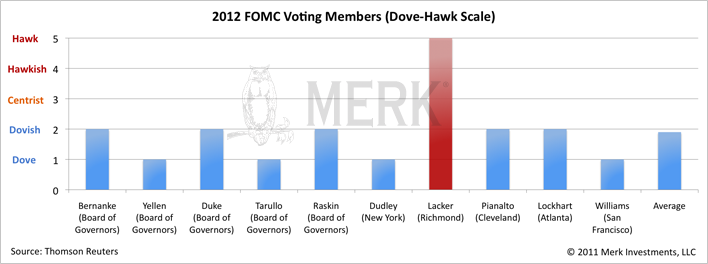

Incidentally, the 2012 FOMC composition reflects that hawks are snowbirds; only one hawk will remain. A stranded hawk may be noisy (dissent and speak out), but might stand little chance against a flight of doves2:

Let us review the Bernanke playbook; all quotes below are taken from his 2002 speech:

Bernanke is determined

- “First, the Fed should try to preserve a buffer zone”, i.e. an implicit or explicit inflation target between 1 and 3 percent.

- “Second, the Fed should take most seriously … its responsibility to ensure financial stability.”

- “Third, …the central bank should act more preemptively and more aggressively…”

- “One relatively straightforward extension of current procedures would be to try to stimulate spending by lowering rates further out along the Treasury term structure – that is, rates on government bonds of longer maturities.”

- “I personally prefer…for the Fed to begin announcing explicit ceilings for yields on longer-maturity Treasury debt (say, bonds maturing within the next two years)."

- “The Fed might next consider attempting to influence directly the yields on privately issued securities…the Fed to offer fixed-term loans to banks at low or zero interest, with a wide range of private assets (including, among others, corporate bonds, commercial paper, bank loans, and mortgages) deemed eligible as collateral. "

- “U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press…that allows it to produce as many U.S. dollar as it wishes at essentially no cost.”

- “By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar…”

- “The Fed has the authority to buy foreign government debt… Potentially, this class of assets offers huge scope for Fed operations, as the quantity of foreign assets eligible for purchase by the Fed is several times the stock of U.S.”

Enough said. While the markets have been “disappointed”, when push comes to shove, Bernanke has stuck to his playbook. He has paved the way for QE3. We have argued that there may not be such a thing as a safe asset anymore, and that investors may want to take a diversified approach to something as mundane as cash. Investors may want to actively manage their U.S. dollar risk, be that for their domestic or international investments. After all, investors may want to position their portfolios to take the risk that Bernanke will do what he has said into account."

No comments:

Post a Comment