http://www.ritholtz.com/blog/2011/01/huprichs-market-truisms-and-axioms/#comments• Commandment #1: “Thou Shall Not Trade Against the Trend.”• Portfolios heavy with underperforming stocks rarely outperform the stock market!• There is nothing new on Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again, mostly due to human nature.• Sell when you can, not when you have to.• Bulls make money, bears make money, and “pigs” get slaughtered.• We can’t control the stock market. The very best we can do is to try to understand what the stock market is trying to tell us.• Understanding mass psychology is just as important as understanding fundamentals and economics.• Learn to take losses quickly, don’t expect to be right all the time, and learn from your mistakes.• Don’t think you can consistently buy at the bottom or sell at the top. This can rarely be consistently done.• When trading, remain objective. Don’t have a preconceived idea or prejudice. Said another way, “the great names in Trading all have the same trait: An ability to shift on a dime when the shifting time comes.”• Any dead fish can go with the flow. Yet, it takes a strong fish to swim against the flow. In other words, what seems “hard” at the time is usually, over time, right.• Even the best looking chart can fall apart for no apparent reason. Thus, never fall in love with a position but instead remain vigilant in managing risk and expectations. Use volume as a confirming guidepost.• When trading, if a stock doesn’t perform as expected within a short time period, either close it out or tighten your stop-loss point.• As long as a stock is acting right and the market is “in-gear,” don’t be in a hurry to take a profit on the whole positions. Scale out instead.• Never let a profitable trade turn into a loss, and never let an initial trading position turn into a long-term one because it is at a loss.• Don’t buy a stock simply because it has had a big decline from its high and is now a “better value;” wait for the market to recognize “value” first.• Don’t average trading losses, meaning don’t put “good” money after “bad.” Adding to a losing position will lead to ruin. Ask the Nobel Laureates of Long-Term Capital Management.• Human emotion is a big enemy of the average investor and trader. Be patient and unemotional. There are periods where traders don’t need to trade.• Wishful thinking can be detrimental to your financial wealth.• Don’t make investment or trading decisions based on tips. Tips are something you leave for good service.• Where there is smoke, there is fire, or there is never just one cockroach: In other words, bad news is usually not a one-time event, more usually follows.• Realize that a loss in the stock market is part of the investment process. The key is not letting it turn into a big one as this could devastate a portfolio.• Said another way, “It’s not the ones that you sell that keep going up that matter. It’s the one that you don’t sell that keeps going down that does.”

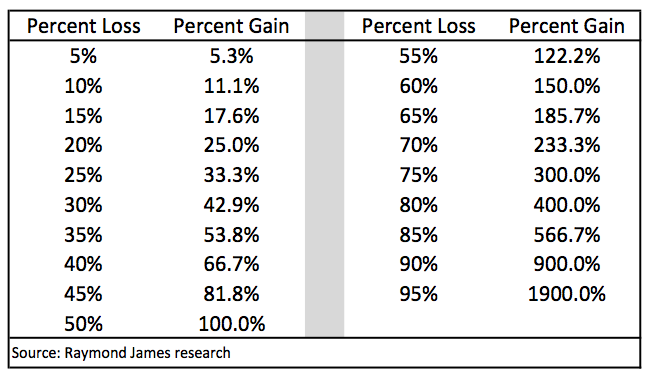

The table below depicts the percentage gain necessary to get back even, after a certain percentage loss.

• Your odds of success improve when you buy stocks when the technical pattern confirms the fundamental opinion.• As many participants have come to realize from 1999 to 2010, during which the S&P 500 has made no upside progress, you can lose money even in the “best companies” if your timing is wrong. Yet, if the technical pattern dictates, you can make money on a short-term basis even in stocks that have a “mixed” fundamental opinion.• To the best of your ability, try to keep your priorities in line. Don’t let the “greed factor” that Wall Street can generate outweigh other just as important areas of your life. Balance the physical, mental, spiritual, relational, and financial needs of life.• Technical analysis is a windsock, not a crystal ball. It is a skill that improves with experience and study. Always be a student, there is always someone smarter than you!

Friday, January 7, 2011

Raymond James’ P. Arthur Huprich Rules of Investing

Thursday, January 6, 2011

Bob Farrell’s 10 rules for investing

Posted by Prieur du Plessis under Investment, Markets, Money

Wall Street “gurus” come and go, but in the case of Bob Farrell legendary status was achieved. He spent several decades as chief stock market analyst at Merrill Lynch & Co. and had a front-row seat at the go-go markets of the late 1960s, mid-1980s and late 1990s, the brutal bear market of 1973-74, and October 1987 crash.

Farrell retired in 1992, but his famous “10 Market Rules to Remember” have lived on and are summarized below, courtesy of The Big Picture and MarketWatch (June 2008). The words of wisdom are timeless and are especially appropriate as investors grapple with the difficult juncture at which stock markets find themselves at this stage.

1. Markets tend to return to the mean over time

When stocks go too far in one direction, they come back. Euphoria and pessimism can cloud people’s heads. It’s easy to get caught up in the heat of the moment and lose perspective.

2. Excesses in one direction will lead to an excess in the opposite direction

Think of the market baseline as attached to a rubber string. Any action too far in one direction not only brings you back to the baseline, but leads to an overshoot in the opposite direction.

3. There are no new eras – excesses are never permanent

Whatever the latest hot sector is, it eventually overheats, mean reverts, and then overshoots.

As the fever builds, a chorus of “this time it’s different” will be heard, even if those exact words are never used. And of course, it – human nature – is never different.

4. Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways

Regardless of how hot a sector is, don’t expect a plateau to work off the excesses. Profits are locked in by selling, and that invariably leads to a significant correction eventually.

5. The public buys the most at the top and the least at the bottom

That’s why contrarian-minded investors can make good money if they follow the sentiment indicators and have good timing. Watch Investors Intelligence (measuring the mood of more than 100 investment newsletter writers) and the American Association of Individual Investors Survey.

6. Fear and greed are stronger than long-term resolve

Investors can be their own worst enemy, particularly when emotions take hold. Gains “make us exuberant; they enhance well-being and promote optimism”, says Santa Clara University finance professor Meir Statman. His studies of investor behavior show that “Losses bring sadness, disgust, fear, regret. Fear increases the sense of risk and some react by shunning stocks.”

7. Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names

This is why breadth and volume are so important. Think of it as strength in numbers. Broad momentum is hard to stop, Farrell observes. Watch for when momentum channels into a small number of stocks.

8. Bear markets have three stages – sharp down, reflexive rebound and a drawn-out fundamental downtrend

9. When all the experts and forecasts agree – something else is going to happen

As Sam Stovall, the S&P investment strategist, puts it: “If everybody’s optimistic, who is left to buy? If everybody’s pessimistic, who’s left to sell?”

Going against the herd as Farrell repeatedly suggests can be very profitable, especially for patient buyers who raise cash from frothy markets and reinvest it when sentiment is darkest.

10. Bull markets are more fun than bear markets

Especially if you are long only or mandated to be fully invested. Those with more flexible charters might squeak out a smile or two here and there.

Sources: The Big Picture, 17 August, 2008 and MarketWatch, June 11, 2008.

Wednesday, January 5, 2011

Top 10 Technical Developments in 2010 - from StockCharts.com

Here are the top 10 technical charting developments that happened during 2010 as selected by our crack staff of technical analysts. See if you agree...

10. Apple surpassed Microsoft in market capitalization on May 26th and gained over 50% on the year.

9. Shanghai Composite continues to show relative weakness.

While the S&P 500 zoomed to new highs in December, the Shanghai Composite ($SSEC) peaked in early November and moved lower in December.

8. Nikkei 225 ($NIKK) perked up with a November breakout.

The index broke neckline resistance from an inverse head-and-shoulders pattern and held this breakout as prices continued higher in December. The relative strength comparative, which compares Nikkei performance to the S&P 500, turned up sharply in November and pulled back in December. Will outperformance continue in 2011?

7. Dow Theory remains on a buy signal.

Both the Dow Industrials and Dow Transports moved above their November highs this month. These higher highs confirm a Dow Theory buy signal. The November lows now mark key support.

6. Small-caps continue to lead large-caps and show no signs of relative weakness.

The chart below shows the Russell 2000 ($RUT) relative to the S&P 100 ($OEX) via the relative strength comparative ($RUT:$OEX ratio). The ratio remains in a clear uptrend.

5. Resurgent finance sector takes over market leadership.

The PerfChart below shows the S&P 500 with the nine sector SPDRs over the last five weeks. Industrials, materials, energy and finance are leading the way. It is a strange group, but relative strength in finance is positive for the market overall. It is also strange that technology and consumer discretionary are lagging.

4. Bonds decline as stocks move higher.

The chart below shows bonds peaking in late August and stocks bottoming at the same time. These two have been moving in opposite directions since August. Money is moving out of bonds and into stocks.

3. Agriculture prices breakout of a two year consolidation.

Higher prices at the farm could eventually lead to higher prices at the supermarket or the restaurant.

2. Oil breaks diamond resistance and exceeds $90 for the first time since the Lehman Brothers collapse.

Strength in the stock market is providing a confidence boost for the economy, which bodes well for oil demand.

1. Long-term rates are poised to challenge resistance from a 20+ year downtrend.

Economic strength and inflationary pressures are weighing on the bond market. Remember, bonds move down as rates move up. A breakout in rates would be long-term bearish for bonds.

So there is our recap of 2010 from a Technical charting perspective. Do you agree? What were your top 10 technical developments of 2010?

Labels:

Markets

Tuesday, January 4, 2011

Monday, January 3, 2011

Sunday, January 2, 2011

Rob Arnott Interview with Eric King

Excellent interview from KWN

Saturday, January 1, 2011

The JibJab 2010 Year in Review

RP-BP is apolitical...

Labels:

humor

Subscribe to:

Posts (Atom)